Sage vs QuickBooks: Which financial software is right for your business?

When choosing financial software for your business, you may find yourself weighing the pros and cons of two popular solutions: Sage and QuickBooks. Both are highly regarded, but they serve different business needs and sizes. Sage is ideal for growing businesses with complex needs, while QuickBooks caters to smaller organizations with simpler requirements. In this blog, we’ll explore Sage vs QuickBooks, highlighting their key differences to help you make an informed decision.

What is Sage?

Sage Intacct is a modern, cloud-based ERP platform specifically designed to support growing businesses with advanced financial management and operational needs. As a true multi-tenant cloud solution, Sage Intacct offers unparalleled accessibility, allowing businesses to manage their finances anytime, anywhere. It automates complex processes like revenue recognition, expense tracking, and multi-entity consolidations, enabling organizations to streamline operations and focus on strategic priorities.

Widely recognized as a leader in the ERP space, Sage Intacct is the only ERP software recommended by the American Institute of Certified Public Accountants (AICPA). Its reputation for excellence is further supported by its consistent ranking as #1 in customer satisfaction. With standout features such as advanced reporting, real-time insights, and robust security, Sage Intacct empowers businesses to make data-driven decisions, scale with confidence, and achieve greater efficiency. It’s an ideal choice for businesses of all sizes seeking reliability, growth, and a competitive edge.

Download the complete comparison guide

Explore a detailed comparison between Sage vs QuickBooks. Download our comprehensive guide today and explore each systems capabilities, scalability, customization, and more.

What is QuickBooks?

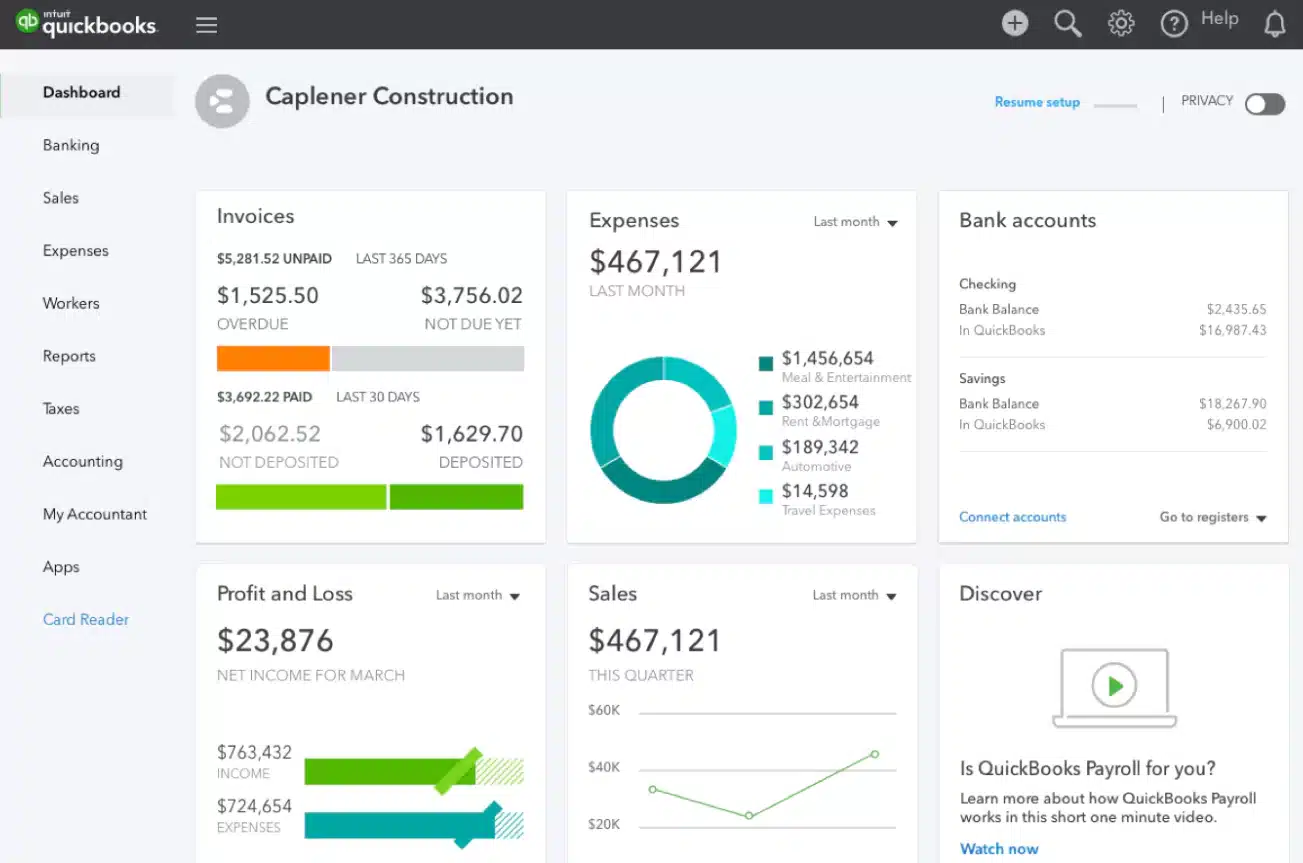

QuickBooks, developed by Intuit, is a popular accounting software designed primarily for small businesses with straightforward financial needs. Options like QuickBooks Online offer basic features such as invoicing, expense tracking, and simple financial reporting, making it an accessible choice for entrepreneurs and freelancers. While its integration with third-party apps like PayPal and Square enhances functionality, QuickBooks Online’s limited scalability and lack of robust financial tools can present challenges for growing businesses. Its user-friendly interface is suitable for startups, but as companies expand and require more sophisticated capabilities, they may outgrow the platform’s offerings.

For organizations seeking more advanced tools, QuickBooks Enterprise provides features like advanced inventory management and customizable reporting. However, its desktop-based nature can restrict accessibility, especially for businesses that need the flexibility of cloud-based solutions. Additionally, while it supports up to 40 users, QuickBooks Enterprise still lacks the comprehensive automation and deep reporting capabilities found in more advanced ERP systems like Sage Intacct. Businesses with complex needs often find QuickBooks an interim solution rather than a long-term investment.

Sage vs QuickBooks

When comparing Sage vs QuickBooks, their differences become clear in terms of scalability, functionality, and target market. QuickBooks, particularly QuickBooks Online, caters to small businesses and freelancers with straightforward financial needs. It is an affordable, entry-level solution offering basic accounting features like invoicing, expense tracking, and simple reporting. However, as businesses grow, QuickBooks often struggles to meet more advanced financial management requirements, such as multi-entity consolidations or deep automation, making it less suitable for scaling businesses.

On the other hand, Sage Intacct is a cloud-native ERP platform designed for businesses of all sizes, from small to large enterprises, with complex financial and operational needs. It provides advanced features such as robust reporting, automation, and multi-entity support, empowering businesses to scale efficiently and manage growth seamlessly. While QuickBooks excels in simplicity and affordability for smaller businesses, Sage Intacct’s comprehensive functionality and scalability make it a more suitable choice for organizations looking to invest in a long-term solution to drive financial and operational excellence.

Sage Intacct is a scalable, cloud-native ERP solution designed for businesses of all sizes, while QuickBooks is a simpler, entry-level accounting software ideal for small businesses and freelancers.

Key differences between Sage and QuickBooks: Why Sage is the better choice

Choosing the right accounting software is crucial for businesses looking to streamline financial processes and scale effectively. While QuickBooks may suit small businesses or startups, Sage Intacct is purpose-built for growing organizations with complex needs. With robust scalability, advanced reporting, industry-specific editions, and automation capabilities, Sage Intacct empowers businesses to operate efficiently and make data-driven decisions. Below, we explore why Sage Intacct is the superior choice for organizations ready to take their financial management to the next level.

- Scalability: Sage Intacct’s cloud-based architecture is built for growth. Organizations can seamlessly add users, entities, and functionalities as their needs evolve. Advanced features like multi-entity management, dimensional reporting, and workflow automation make it an ideal choice for businesses managing operations across multiple locations or dealing with complex financial structures. In contrast, QuickBooks offers limited scalability. Its constraints on user numbers, transaction volumes, and advanced functionalities can quickly become a bottleneck for expanding organizations.

- Customization: Sage Intacct provides advanced customization capabilities, allowing businesses to adjust reports, dashboards, and workflows to meet their specific needs. Users can design custom reports and make modifications to fields, giving them the flexibility to adapt the software to their unique business requirements. QuickBooks, on the other hand, offers limited customization, focusing on basic needs like invoice and form adjustments. For businesses that require deeper customization, especially in industries like manufacturing or construction, Sage Intacct provides a far more flexible and adaptable solution.

- Integrations: Sage Intacct offers a robust integration ecosystem with its open API architecture, enabling businesses to connect seamlessly with a wide array of third-party tools such as Salesforce, ADP, and e-commerce platforms. This is especially useful for businesses looking to automate and streamline workflows across different systems. QuickBooks also supports integrations with popular applications but its integration process can be more cumbersome and less seamless compared to Sage Intacct, often requiring additional development resources.

- Industry-specific editions: Sage Intacct stands out with industry-specific editions tailored to sectors such as construction, distribution, senior living, family office, nonprofit, hospitality, healthcare, and more. These editions come equipped with specialized modules and features to address the unique challenges of each industry. QuickBooks lacks such tailored versions, requiring extensive manual adjustments or third-party add-ons to meet industry-specific requirements.

- Financial visibility: With features like dimensional reporting and customizable dashboards, Sage Intacct provides advanced, real-time financial reporting, giving businesses access to up-to-date data that enables informed decision-making. QuickBooks, by contrast, lacks the depth of reporting capabilities limiting businesses in their ability to gain comprehensive financial visibility and make timely, data-driven decisions.

- Automation: Sage Intacct offers advanced automation features that help businesses reduce manual tasks, increase efficiency, and minimize errors. This includes automating workflows like accounts payable and receivable, allowing accounting teams to focus on higher-value tasks. While QuickBooks provides basic automation, it does not match the level of efficiency and sophistication that Sage Intacct offers. As companies grow, they need a system that can handle routine tasks automatically, and Sage Intacct’s robust automation is a key advantage over QuickBooks.

- Multi-entity management: For businesses with multiple subsidiaries or locations, Sage Intacct’s multi-entity management capabilities are invaluable. It allows businesses to manage complex structures by consolidating financial data, handling inter-entity transactions, and reporting across different entities seamlessly. QuickBooks lacks this level of multi-entity support, making it challenging for businesses to track financial performance across multiple subsidiaries or locations.

- Revenue recognition: Sage Intacct offers advanced revenue recognition tools, supporting complex, multi-element arrangements and ensuring compliance with standards like ASC 606 and IFRS 15. These features are essential for businesses that need to manage revenue from multiple sources or have complex revenue recognition requirements. QuickBooks Enterprise offers basic revenue recognition, but it is not as robust, particularly for businesses that require a more sophisticated solution for recognizing and reporting revenue.

How to get Sage

Sage Intacct is available through the Sage Partner Network, a group of trusted advisors and implementation experts dedicated to helping businesses achieve success with Sage solutions. When you work with a Sage Partner, you gain access to expert guidance, personalized support, and industry-specific expertise to ensure a seamless implementation.

As a Diamond Sage Business Partner, MicroAccounting is a trusted Sage partner, known for delivering exceptional service and results. With over 1,000 successful implementations and decades of experience, we specialize in helping businesses leverage Sage Intacct to drive operational efficiency and financial success.

Services include:

- Needs assessment & software selection: We’ll help you determine if Sage Intacct is the right fit for your business.

- Implementation: From configuration to go-live, we ensure a smooth transition with minimal disruption to your operations.

- Customization: Tailor Sage Intacct to your business with personalized workflows, dashboards, and reports.

- Training & support: Empower your team with the skills they need to maximize Sage Intacct’s features and rely on our ongoing support for continued success.

- Optimization: Already using Sage Intacct? We can help you enhance your system to better meet your evolving business needs.

At MicroAccounting, our mission is to empower businesses to thrive with the right financial software and services. Whether you’re just starting your journey with Sage Intacct or looking to optimize your current solution, we have the expertise and resources to guide you every step of the way.

Ready to see Sage in action?

Ready to elevate your financial management? Experience the power of Sage Intacct with a personalized demo tailored to your business needs. Discover how its advanced features, automation, and real-time insights can transform your operations.

Next steps

When comparing Sage Intacct and QuickBooks, the differences are clear: Sage Intacct offers unparalleled scalability, advanced reporting, and industry-specific editions, making it ideal for businesses with complex needs and growth ambitions. While QuickBooks may work for smaller organizations with straightforward requirements, it often falls short in automation, multi-entity management, and integration capabilities. Sage Intacct stands out as the better choice for companies seeking a flexible, cloud-based solution designed to evolve alongside their business.

At MicroAccounting, we specialize in helping businesses navigate the complexities of financial management with tailored solutions like Sage Intacct. As a trusted provider of ERP and accounting software, we offer implementation, support, and consulting services to ensure your systems are optimized for success. Whether you’re managing a small business or a large enterprise, our team of experts is here to guide you every step of the way. Contact us today to learn how we can help transform your financial processes and empower your business to grow.