Sage Intacct AI: What it is, how it works, and why it matters

Artificial intelligence is changing the way businesses operate, and finance teams are no exception. Sage Intacct AI accelerates that transformation by embedding intelligence into routine finance tasks. Featuring Sage Copilot, an AI assistant, it streamlines repetitive tasks, surfaces critical insights, and quickly delivers the information teams need to improve performance. Its deep integration with Sage Intacct and other Sage tools allows teams to shift their effort from manual processes to strategic initiatives. In this blog, we’ll explore what Sage Intacct AI is, its core capabilities, real-world use cases, and how it can help finance teams work smarter.

What is Sage Intacct AI

Sage Intacct AI is a suite of embedded AI and generative AI features designed to improve financial management for small and midsized businesses. Unlike traditional ERP tools, Sage Intacct AI continuously analyzes financial data, automates low-value tasks, and delivers real-time insights that finance leaders can trust.

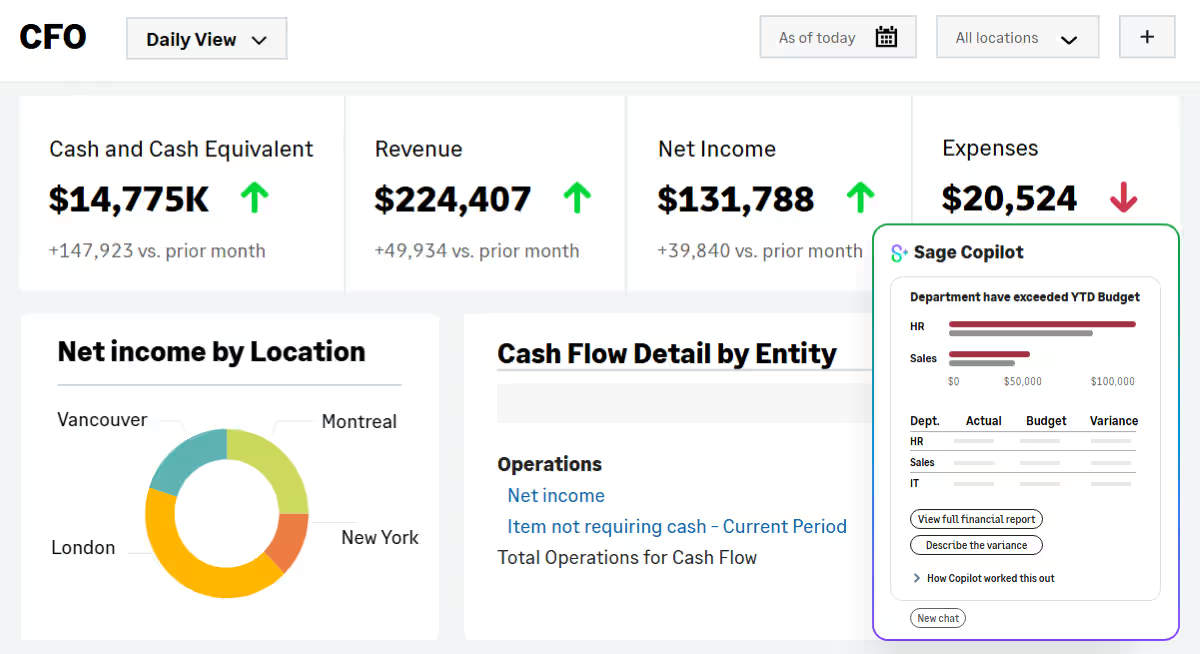

With Sage Copilot—the conversational AI assistant—teams can instantly access information they would normally search for in spreadsheets or reports:

- Overdue invoices

- Cash flow summaries

- Budget variances

- Unusual or high-risk transactions

- Variance explanations

By reducing manual data entry, enabling predictive analysis, and supporting faster decision-making, Intacct AI helps organizations maintain accuracy, reduce risk, and accelerate performance.

Key benefits include:

- Automation of routine finance tasks

- Immediate insights across financial workflows

- Support for strategic decision-making

- Increased efficiency and financial integrity

- Up-to-date, trustworthy data

Because Copilot is context-aware (understanding accounts, entities, approval rules, and historical patterns), it doesn’t just answer questions — it provides interpretation. For example: “Your utilities spend is 18% above trend due to a spike in Q3 rates. Should I draft a vendor review summary?”

This ability to provide actionable guidance, not just data, is a major differentiator compared to legacy ERP reporting.

Make smarter decisions powered by AI

Discover how Sage Intacct AI can revolutionize your financial workflows. Automate routine tasks, enhance accuracy, and accelerate business growth. Rand Group can help you explore Sage Intacct AI and begin optimizing your finance operations today.

Core Sage Intacct AI-powered capabilities

Accounts payable

Sage Intacct AI automates invoice processing and AP automation. Automatically compare data, flag unusual transactions, and maintain financial integrity. According to Sage, invoice processing time can be cut by over 50% with its AP automation features.

Capabilities:

- Automates invoice processing and reduces manual data entry

- Flags regulatory issues and unusual transactions

- Provides actionable insights for smarter decisions

- Allows finance teams to focus on higher-value work

Example:

Sage Intacct AI can identify “behavioral anomalies” such as a vendor suddenly billing 2–3× more frequently or submitting invoices at unusual times—patterns associated with fraud or accidental duplication. Traditional ERP systems rarely detect these issues without manual review.

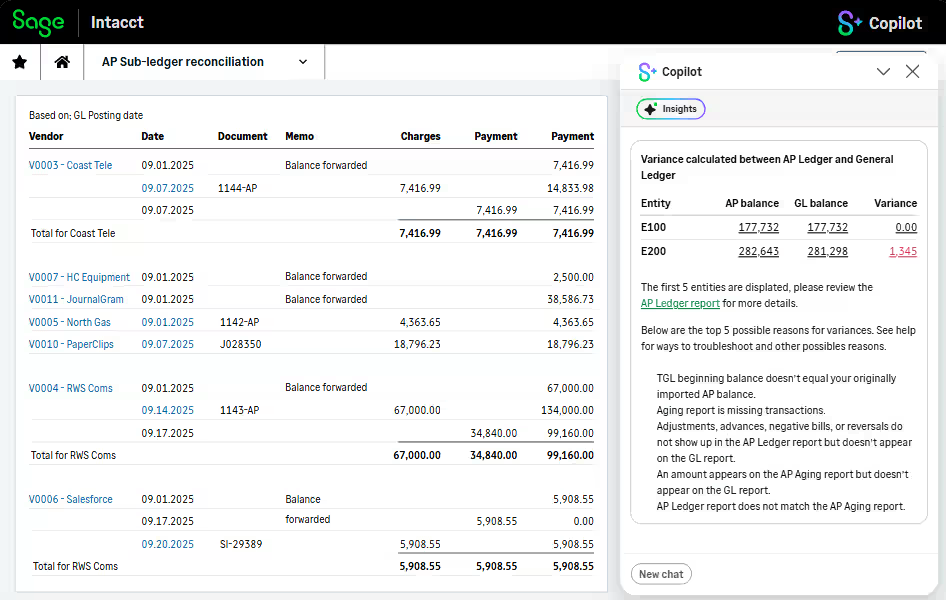

Cash management and reconciliation

Sage Intacct AI streamlines cash flow management by matching transactions in the general ledger and spotting duplicate or missing entries. This efficiency gain helps finance teams close the books faster.

Capabilities:

- Provides instant insights into cash flow and financial data

- Automates reconciliation and detects anomalies

- Supports operational efficiency and improves financial integrity

- Reduces time-consuming tasks for the month-end close

Insight:

AI-driven reconciliation is moving accounting away from scheduled batch processes toward “continuous close,” where mismatches or anomalies surface the same day they occur. This reduces costly downstream corrections and helps companies produce near real-time dashboards for stakeholders.

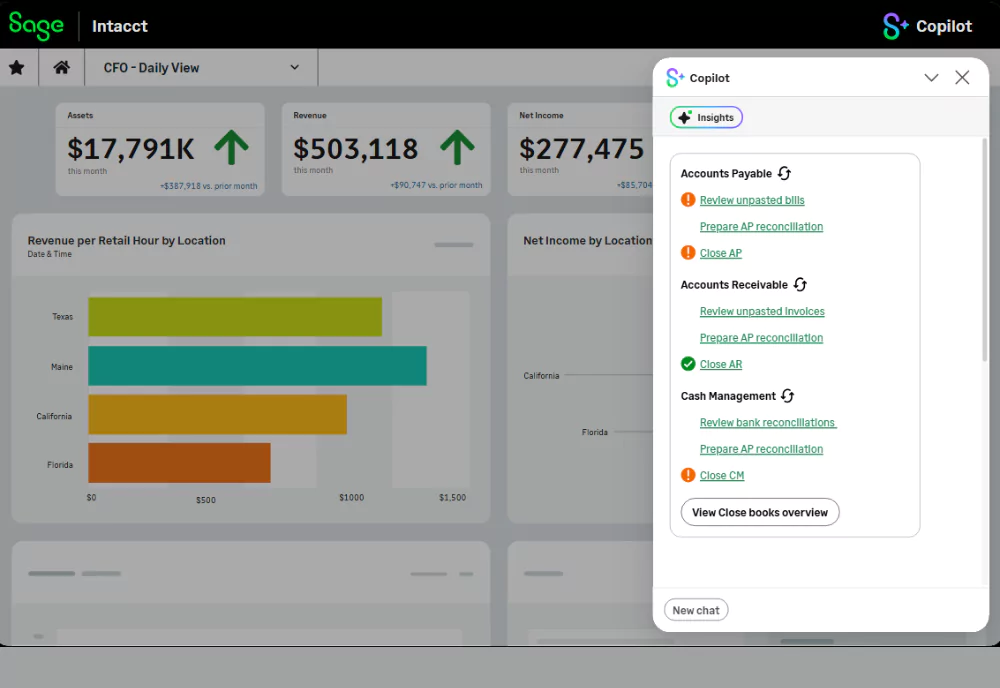

Close management

During the month-end close, Sage Intacct AI monitors progress in the close workspace and surfaces actionable insights. Proactive notifications alert teams to bottlenecks and unusual transactions, helping maintain accuracy and compliance.

Capabilities:

- Tracks up-to-the-minute month-end close progress

- Identifies bottlenecks and unusual transactions

- Supports accurate reporting and financial integrity

- Provides tailored solutions to boost efficiency

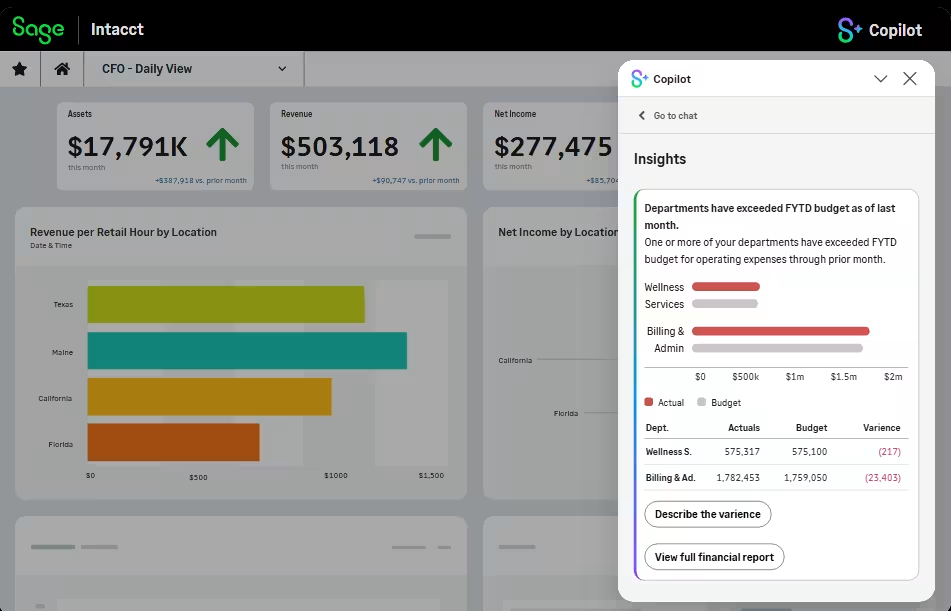

Proactive insights and reporting

Sage Intacct AI delivers insights across financial workflows. Copilot generates plain-language summaries, highlights budget variances, and surfaces trends finance leaders need to make informed decisions.

Capabilities:

- Flags trends and risk factors in real time

- Surfaces budget and actual variances

- Provides contextual explanations for variances

Insight:

Finance leaders who pair AI insights with cross-functional planning tools are better positioned to influence organizational strategy — closing the historical gap between finance reporting and enterprise decision-making.

White Paper:

AI’s role in modernizing finance

Explore how AI and automation are reshaping month-end close processes. This white paper shows how Sage Copilot reduces manual tasks, improves accuracy, and helps finance teams work more efficiently.

Sage Intacct AI real-world applications

Accounts payable clerks

- Automatically extract, validate, and code invoice data from PDFs or emails, reducing manual keying errors

- Flag duplicate invoices or mismatched PO/receipt details before they hit the approval queue

- Generate exception lists so AP teams only review items that genuinely need human attention

- Predict approval bottlenecks and recommend alternative approvers to keep payables moving

Accounts receivable teams

- Get proactive reminders when key customers show payment-delay patterns

- Automatically prioritize follow-ups based on invoice size, aging, and customer history

- Generate draft collection emails tailored to each customer and ready for quick send

- Identify missing or inconsistent customer data so AR teams can correct issues before invoicing

Controllers

- Receive early alerts when spending spikes in a specific department or vendor category

- Detect unusual GL entries before the close, preventing last-minute reconciliations

- Automate variance explanations by pulling data from subledgers and presenting a clear summary

- Use Sage Copilot as a “close assistant” to track task completion, identify blockers, and highlight accounts needing review

CFOs

- Get real-time cash flow forecasts adjusted automatically as new AP/AR data enters the system

- Receive personalized summaries of budget variances with drivers explained in plain language

- Ask Copilot natural-language questions like “How does Q3 revenue compare to last year?” and get instant, sourced answers

- Monitor financial health across entities, with Copilot surfacing emerging risks and opportunities

Security and compliance

Sage Intacct AI is built with security and compliance at its core. It ensures financial integrity and supports strict regulatory requirements. The platform safeguards sensitive data through strong access controls and encryption. Additionally, it uses automated monitoring to protect both customer and company information. The system also flags anomalies or potential compliance issues early, helping teams act before problems escalate. Continuous workflow monitoring further reduces risk and strengthens internal controls. Finally, regular updates and security patches keep the environment secure, reliable, and aligned with evolving standards.

Scalability, flexibility, and customization

Sage Intacct AI scales with businesses as they grow, adapting easily to changing needs and evolving financial processes. Its flexibility allows organizations to design tailored solutions that match unique workflows. The platform also integrates seamlessly with other Sage products. This versatility helps teams maintain consistency as they expand. As a result, organizations at any growth stage can improve efficiency, reduce manual effort, and streamline everyday operations.

Implementation and support

Getting started with Sage Intacct AI is straightforward. It requires minimal technical expertise, which simplifies the onboarding process. Rand Group, a trusted Sage partner, helps configure the solution for each organization. We also provide training that builds confidence and supports faster adoption. Furthermore, our proactive support includes online, phone, and on-site options. This blended approach ensures finance teams always have access to help when they need it. The result is a smooth rollout and continuous productivity without disruption.

Conclusion

Finance is evolving from reactive, spreadsheet-heavy processes to intelligent, AI-powered financial management. Sage Intacct AI transforms financial workflows by automating routine tasks, providing valuable insights, and ensuring financial integrity. From accounts payable to predictive analytics and month-end close, it empowers finance teams to save time and drive strategic business growth.

As a trusted Sage partner for over 30 years, Rand Group provides tailored solutions, implementation support, and training to ensure finance teams get the most from Sage products. Our expertise helps businesses streamline financial workflows, maintain compliance, and achieve measurable ROI. Contact us to see how Sage Intacct AI and Copilot can work for your business and drive real results.