What is dimensional accounting and how can it help you?

Dimensional accounting streamlines financial reporting by allowing you to tag transactions with customizable dimensions—like department, location, or project—instead of creating a separate general ledger account for every scenario, resulting in a cleaner chart of accounts and more flexible, detailed analysis for better business decision-making.

For organizations that need to report on multiple general ledger (GL) accounts, departments, locations, or other business segments, traditional ERP systems require a fully qualified GL account for every possible combination. This quickly adds up, leading to hundreds—or even thousands—of accounts to manage and a bloated chart of accounts.

For example, if you have 50 natural GL accounts and 5 departments, you would need 250 fully qualified accounts—before even considering locations or other segments. This structure can make reporting cumbersome and account maintenance overwhelming.

A more streamlined and flexible approach is dimensional accounting. Instead of creating a unique account for every reporting scenario, dimensional accounting lets you categorize, label, or tag transactions with pre-defined accounting dimensions. These dimensions provide deeper insights into business performance and support better decision-making.

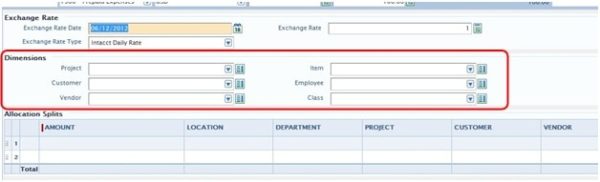

By organizing financial data using dimensions, dimensional accounting enables detailed, multi-level analysis and simplifies the process of improving operational and financial outcomes. The image below illustrates how dimensions are tagged in a transaction:

What are accounting dimensions?

Accounting dimensions serve as a replacement for subaccounts in your GL. Instead of adding segments like “location,” “project,” or “department” into your account string, you define these as dimensions—each tracked separately. This makes data entry easier and keeps your chart of accounts clean and manageable.

Each transaction can be tagged with the relevant dimension values. For example, instead of creating a new GL account for every department-location combination, you simply select the department and location dimensions when entering a transaction.

You can also establish relationships between dimensions to streamline data entry and improve accuracy. Relationships can be one-to-many (e.g., one location with many projects), many-to-one (multiple departments for a single project), one-to-one, or many-to-many to fit your organization’s structure. Each business unit or segment can be tracked independently for efficient reporting.

Many modern financial systems, such as Sage Intacct support dimensions, allowing you to tag transactions throughout your processes. These systems can even require certain dimension values for specific GL accounts, ensuring you don’t miss important reporting details.

Built-in reporting tools in these solutions make it easy to use dimension data for analysis—eliminating the need for complex report writing or custom development.

How can dimensional accounting help you with financial reporting?

Traditionally, adding a new department or location required creating a new set of GL accounts and updating your reports to include those accounts. With dimensional accounting, you simply add a new dimension value, and it becomes immediately available throughout your system and in all financial statements.

Dimensional accounting streamlines your chart of accounts and speeds up every step of financial management—setup, data entry, and reporting. It provides detailed visibility into the performance of each entity, department, or location individually and collectively, making it easier to optimize your financial reports and support better business planning.

Other dimensional relationship ideas

Dimensions are flexible and can be used for a variety of business relationships, both standard and user-defined. For example:

- Assign a single salesperson to a customer

- Assign a list of employees to a location

- Assign employees to multiple projects

- Assign employees to a location

- Limit certain GL account numbers to a location or cost center to track revenue and expenses by area

With dimensions, you can more easily analyze your balance sheet, track revenue, and control costs. This approach is powerful yet straightforward, supporting granular reporting and easy data entry without adding administrative burden.

Dimensional accounting eliminates much of the complexity that system administrators have traditionally faced, making setup quick and easy. It gives your organization the flexibility to grow and change without overwhelming your finance team or requiring massive backend updates.

Next steps

If you are ready to simplify your chart of accounts, streamline financial reporting, and gain deeper business insights, Rand Group can help. Our experienced team specializes in implementing and optimizing Sage Intacct and other cloud-based platforms—with a strong focus on dimensional accounting.

We guide you through the entire process—from evaluating your current structure to implementing dimensions, customizing reporting, and training your staff. Whether you’re upgrading from a legacy ERP or looking for strategies to modernize your financial management, Rand Group provides the expertise and support you need for success.

Contact Rand Group today to discuss how dimensional accounting can benefit your organization, or visit our insights section for more resources on financial management and reporting best practices.