Asset management: take control of your entire fixed-assets lifecycle

Effective asset management requires a comprehensive approach that allows you to handle every stage of the asset lifecycle. To get the highest tax benefit and value from your company’s physical assets, you need to do more than simply track depreciation. From acquisition and tracking to revaluations, transfers, and eventual disposal, having the right tools and processes in place ensures compliance, maximizes tax benefits — and helps you make informed decisions to optimize your assets’ value over time.

Sage Fixed Assets—streamline your asset management

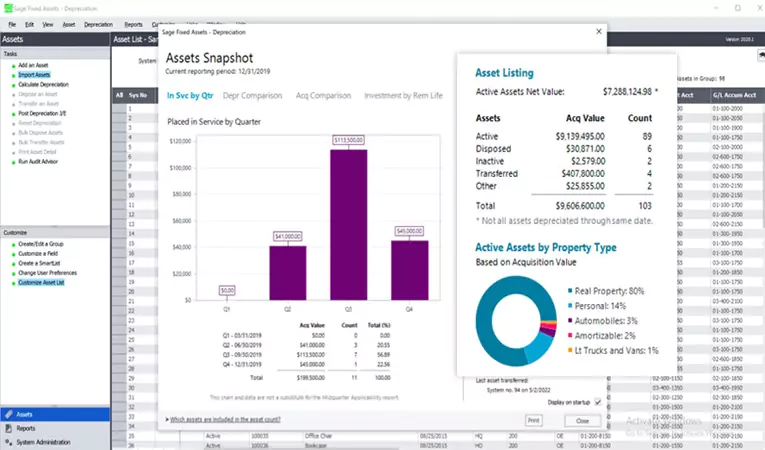

Managing your company’s fixed assets is easier than you might expect. Sage Fixed Assets provides a powerful, all-in-one solution that gives you full visibility and control over the entire asset lifecycle—from acquisition and creation to depreciation and eventual disposal. Fully integrated with Sage 100 and Sage Intacct, this software ensures precise asset tracking, accurate financial reporting, and compliance with regulatory standards. Whether you’re overseeing a small inventory of equipment or a large portfolio of assets, Sage Fixed Assets streamlines the process, minimizes errors, and frees up valuable time so you can focus on growing your business.

Maximize tax savings

Stay ahead of IRS requirements with automated annual federal tax compliance updates. The Sage Fixed Assets depreciation module includes pre-built tax forms and worksheets, such as forms 3468, 4255, 4562, 4626, and 4797, to help streamline tax filings and maximize savings.

Reduce operating costs

Effectively budget and track project expenses before they become fixed assets. Accurately project depreciation across your assets’ life cycles using various scenarios, and maintain reliable records with automatic timestamps. This helps reduce risk, avoid tax penalties, and control operating costs.

Eliminate ghost and zombie assets

Safeguard your business from unnecessary losses and risks by identifying and eliminating ghost and zombie assets. Sage Fixed Assets protects you from fraud, overpaying property taxes, and inflated insurance premiums, ensuring your business operates efficiently and without hidden costs.

Product Sheet

Sage Fixed Assets: Depreciation

Fixed asset depreciation is one of the most important financial processes for organizations of any size. Yet many are still using Excel as their depreciation software. View this product sheet to see how Sage Fixed Assets can save your company from some serious consequences in tax liability, compliance-standards violations, and profit loss.

Streamline the entire fixed assets process

Gain full visibility and control over your fixed assets with our comprehensive system, built around four powerful modules designed to streamline every aspect of asset management.

- Planning—Plan with precision and confidence. Manage multiple projects of any size or type with ease, ensuring no detail is overlooked.

- Depreciation—Leverage over 50 depreciation methods to effectively oversee the entire lifecycle of your fixed assets. Streamline your year-end financial preparations with ease.

- Tracking—Prevent lost or stolen assets while lowering insurance expenses and avoiding tax overpayments. Stay in control of your assets at all times.

- Reporting—Generate detailed, customizable reports for a complete overview of your asset inventory across your organization.