Sage 100 Payroll: Streamlined payroll management

Sage 100 Payroll simplifies payroll for small to mid-sized businesses. Integrated with Sage 100 ERP, it enables employees and managers to easily access compensation, tax information, and reporting. This unified software system improves accuracy and reduces manual work. As a result, the payroll team and HR save time and focus on higher-value tasks.

Simplify payroll processing with Sage 100 Payroll

Sage 100 Payroll simplifies payroll processing by automating tasks and ensuring tax compliance. Additionally, the payroll module in Sage 100 ERP offers advanced functionality. It includes seamless integration with other ERP features such as accounting, HR, and time tracking. You can manage payroll processes either in-house or through external providers, giving your business flexibility and control. No matter which option you choose, Sage 100 Payroll fully supports both approaches while maintaining accuracy and efficiency. It also provides detailed, accurate reporting and analytics, helping you make informed decisions. All of this happens within the familiar Sage 100 ERP environment, saving time and reducing errors.

Automated tax calculations

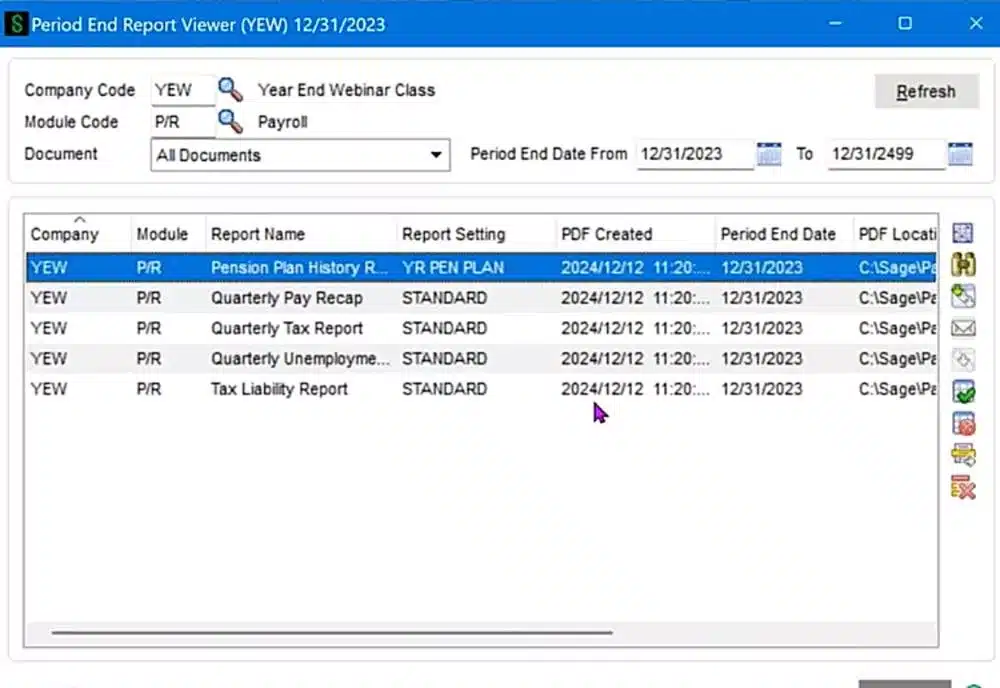

Stay current with federal, state, and local tax changes automatically. This reduces errors and ensures tax compliance for small to mid-sized businesses. Furthermore, users can reverse check runs, keeping payroll accurate and efficient.

Direct deposit and e-filing

Pay employees securely with direct deposit. Automated W-2 and 1099 e-filing simplifies year-end reporting and reduces manual work. In addition, it ensures payroll processes remain accurate while staff can access reports and check history online.

Automated tax calculations

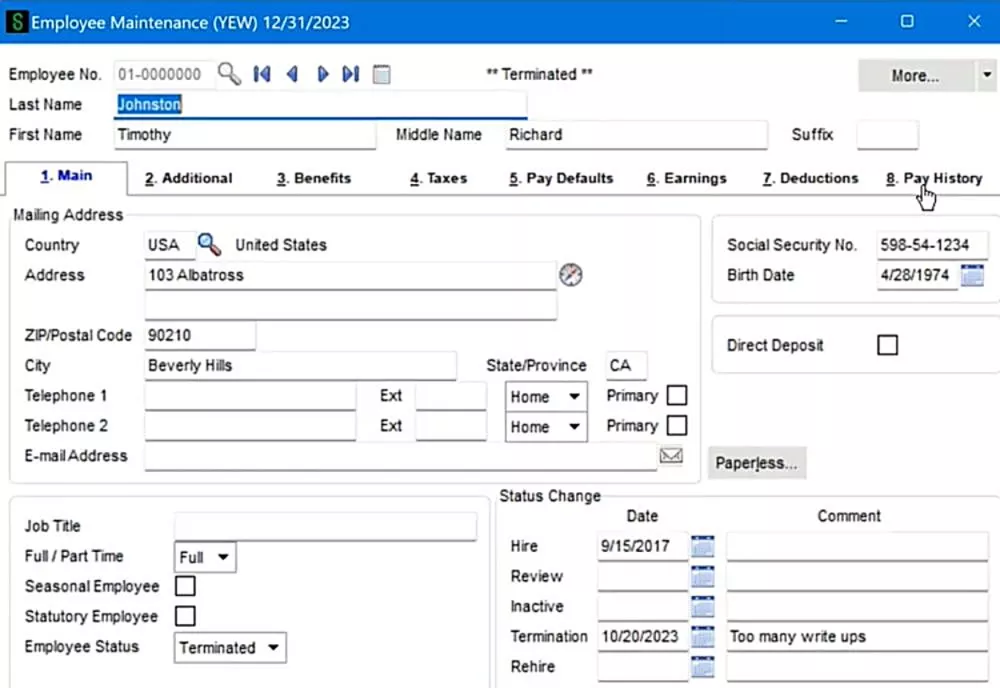

Employees can securely view pay statements, tax forms, and compensation. This improves transparency and reduces HR inquiries. In addition, staff can track earnings and deductions efficiently so your team can quickly respond to questions.

Brochure

Guide to Sage 100 Payroll

Get the complete guide to Sage 100 Payroll. Learn how to automate payroll, streamline reporting, and improve efficiency across your business.

Accurate, compliant, and scalable payroll with Sage 100 Payroll

Sage 100 Payroll offers a streamlined solution that minimizes errors, enhances compliance, and fosters business growth. Centralizing payroll, taxes, and reporting in Sage 100 ERP saves time and reduces costs. Furthermore, automation and seamless integration simplify processes and improve accuracy so finance and HR can focus on higher-value work. The latest updates to Sage Payroll software have enhanced system performance, making processing payroll even faster and more reliable.

- Increased efficiency: Automates payroll processes, reduces manual entry, and minimizes errors.

- Enhanced compliance: Keeps your business up to date with tax rules and simplifies reporting.

- Cost savings: Reduces the need for outside payroll services and lowers compliance risks.

- Flexible payroll options: Easily select specific payroll preferences with simple checkboxes to tailor processes to your business needs.

- Scalability: Supports multiple companies, complex payroll structures, and business growth.

Integration with Sage 100 modules

Sage 100 Payroll connects seamlessly with Job Cost, Time Tracker, Production Management, HRMS, and Inventory Management modules. Employee hours, labor costs, and project expenses flow automatically into Payroll and financial reporting. This keeps processes accurate and reduces errors across systems. Key benefits include:

- Accurate time and labor tracking: Employee hours recorded in Time Tracker sync automatically with Payroll.

- Precise job cost tracking: Labor costs are allocated to projects or departments in real time. This supports detailed tracking for specific projects.

- Department allocation: Assign employer tax codes to different General Ledger accounts using the Department feature and Department Maintenance. This provides flexible cost tracking for multi-tax and multi-state scenarios.

- Streamlined HR-payroll data: HRMS integration keeps employee records, deductions, and benefits consistent.

- Improved reporting: Payroll and operational data flow directly into financial reports. Additionally, you can print various reports and check registers.

- Supports growth: Handles multiple entities, complex payroll structures, and expanding operations without added complexity.

Why partner with Rand Group?

Leading Sage partner in North America

Rand Group ranks among the top 1% of Sage partners in North America. Recognized by G2 for our services, we deliver expert Sage solutions. Our performance earns trust through proven results and client satisfaction.

Committed to your long-term success

We focus on building lasting relationships with clients. Rand Group offers ongoing support and services. Our 95% client retention rate demonstrates our commitment to our clients’ success.

Proven industry knowledge

Our team includes CPAs and experienced industry professionals. We tailor Sage 100 implementations and integrations to meet your goals. By following industry best practices, we deliver dependable, efficient solutions you can rely on.

U.S.-based support team

All Rand Group team members are based in the United States. We never outsource work overseas. This ensures consistent, high-quality service throughout every stage of your Sage 100 implementation and long-term support.