Best ERP software for family offices

Managing a family office involves far more complexity than traditional financial operations. From multi-entity accounting and consolidated reporting to investment tracking and multi-generational wealth oversight, family offices must manage diverse assets, entities, and stakeholders with precision. Without the right technology in place, these responsibilities often rely on disconnected systems and manual processes, increasing risk and limiting visibility.

That’s why selecting the best ERP software for family offices is a critical decision. A well-designed ERP system centralizes financial data, streamlines workflows, and provides real-time insights across entities and investments, helping family offices operate more efficiently while maintaining strong financial controls. In this blog, we’ll explore the key features family offices should look for in an ERP system, review the top ERP solutions, with a side-by-side comparison of Sage Intacct, NetSuite, and Microsoft Dynamics 365 Business Central. Plus, we’ll explain how Rand Group can help your family office select, customize, and implement the right ERP to support long-term growth and succession planning.

Key features to look for in a family office ERP

Not all ERP systems are designed to handle the unique complexity of a family office. While standard ERP platforms may cover basic accounting and operations, family offices require solutions that support sophisticated financial structures, investment oversight, and long-term wealth planning. The right ERP should not only manage day-to-day financial activities but also provide a consolidated, accurate view of assets and performance across all entities.

When evaluating ERP solutions, family offices should prioritize features that support both financial management and wealth oversight, reduce reliance on manual processes, and scale as the family’s needs evolve:

- Multi-entity consolidation – Essential for tracking multiple entities, subsidiaries, trusts, and investments.

- Investment management – Tools to monitor portfolio performance, allocations, and asset growth.

- Automated data aggregation – Reduce manual input, streamline workflows, and minimize errors.

- Advanced reporting & customization – Tailored dashboards and reports to meet complex financial needs.

- Cloud accessibility & security – Secure cloud platforms allow access across geographies and devices.

Best ERP software for family offices

Here’s a closer look at leading ERP solutions and why they are well-suited for family offices:

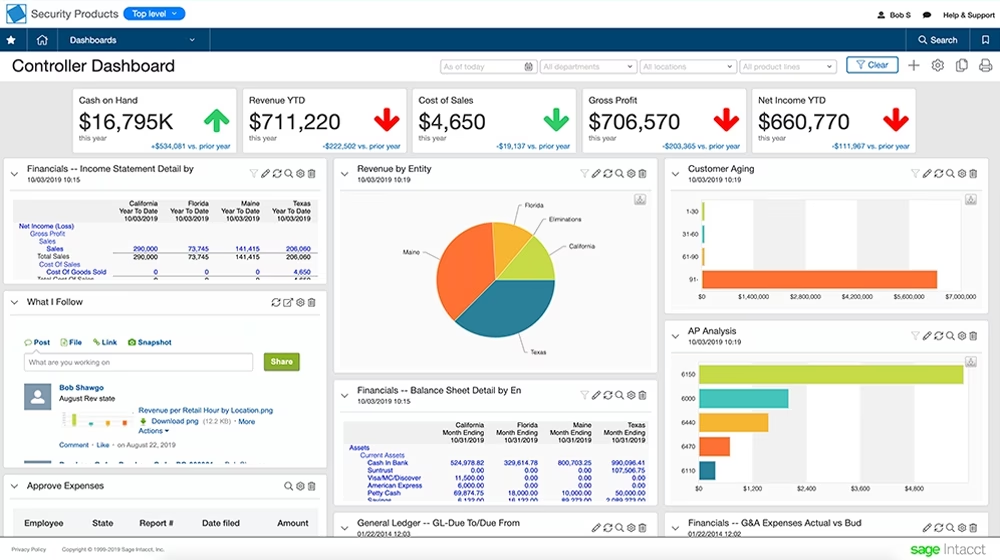

Sage Intacct

Sage Intacct is a cloud-based financial management and ERP solution that stands out for family offices seeking a modern platform designed to handle the complexity of multi-entity financials, investments, and reporting. Trusted to manage more than $1.3 trillion in assets under management, Sage Intacct helps family offices operate with greater confidence by reducing manual processes, improving accuracy, and delivering real-time financial insights that support long-term decision-making across generations.

Unlike basic accounting systems that rely heavily on spreadsheets and manual consolidation, Sage Intacct offers native, purpose-built, tools that streamline financial workflows, accelerate the close process, and provide deep visibility into performance across entities. Its cloud-native architecture ensures secure access from anywhere, supports integrations with other systems, and eliminates the need for costly upgrades or on-premise maintenance.

Key family office capabilities:

- Continuous multi-entity consolidation: Automatically consolidate financials across multiple legal entities, trusts, and investment structures in real time, eliminating error-prone spreadsheets and significantly reducing close times.

- Advanced reporting and dashboards: Create customized financial reports and dashboards that track profit and loss, cash flow, assets under management, and fair market value, with drill-down capabilities for detailed analysis.

- Investment performance tracking: Monitor investment activity and performance across asset classes, helping family office leaders make informed portfolio and allocation decisions.

- Audit-ready controls and compliance: Built-in audit trails and strong financial controls support compliance requirements and ensure transparency across all transactions.

- Cloud-based accessibility and security: Secure, role-based access allows stakeholders to view financial data from anywhere while maintaining strong governance and data protection.

- Support for multi-generational wealth management: Manage distributions, trusts, and estate-related accounting while generating tailored reports for family members and advisors.

Overall, Sage Intacct is a leading choice for family offices that require deep financial visibility, automated multi-entity consolidation, and powerful reporting capabilities within a scalable, cloud-based ERP platform.

Case Study:

Transforming multi-entity financial management with Sage Intacct

Learn why B-29 Investments, LP chose to implement Sage Intacct for their family office financial management. Plus discover key successes they’ve achieved since making the switch.

Microsoft Dynamics 365 Business Central

Microsoft Dynamics 365 Business Central is a flexible, cloud-based ERP solution designed to support organizations with evolving financial and operational needs. For family offices, Business Central provides a strong foundation for core accounting, reporting, and multi-entity management, while offering extensive customization capabilities to address the unique requirements of complex wealth structures.

One of the key advantages of Business Central is its adaptability. While it is not a family office–specific platform out of the box, its open architecture and deep integration with the Microsoft ecosystem allow it to be tailored to support multi-entity accounting, investment tracking, and custom reporting. Our Microsoft experts have extensive experience customizing Business Central across a wide range of industries, including family offices. We can configure the system to align with unique ownership structures, workflows, and reporting needs.

Business Central integrates seamlessly with Microsoft tools such as Excel, Power BI, Teams, and Outlook, enabling finance teams to work within familiar environments while gaining enhanced visibility and control over financial data. This integration, combined with tailored configurations, allows family offices to streamline processes and scale their ERP as their needs grow.

Key family office capabilities:

- Custom multi-entity accounting: Configure Business Central to manage multiple entities, trusts, and investment vehicles, with tailored consolidation and intercompany workflows.

- Flexible customization and extensions: Leverage Rand Group’s expertise to design custom fields, workflows, and integrations that support family office–specific processes and reporting requirements.

- Advanced reporting with Power BI: Create interactive dashboards and reports that provide real-time insight into financial performance, cash flow, and portfolio activity across entities.

- Microsoft ecosystem integration: Seamlessly connect with Excel, SharePoint, Teams, and Outlook to improve collaboration and reduce manual data handling.

- Scalable cloud-based platform: Easily support new entities, investments, and reporting requirements as the family office grows or evolves.

- Role-based security and controls: Ensure sensitive financial information is accessible only to authorized users, supporting governance and confidentiality.

With the right customization partner, Microsoft Dynamics 365 Business Central can become a powerful ERP solution for family offices. Our proven experience tailoring Business Central for diverse industries enables family offices to transform a flexible platform into a solution that supports complex financial structures, long-term planning, and operational efficiency.

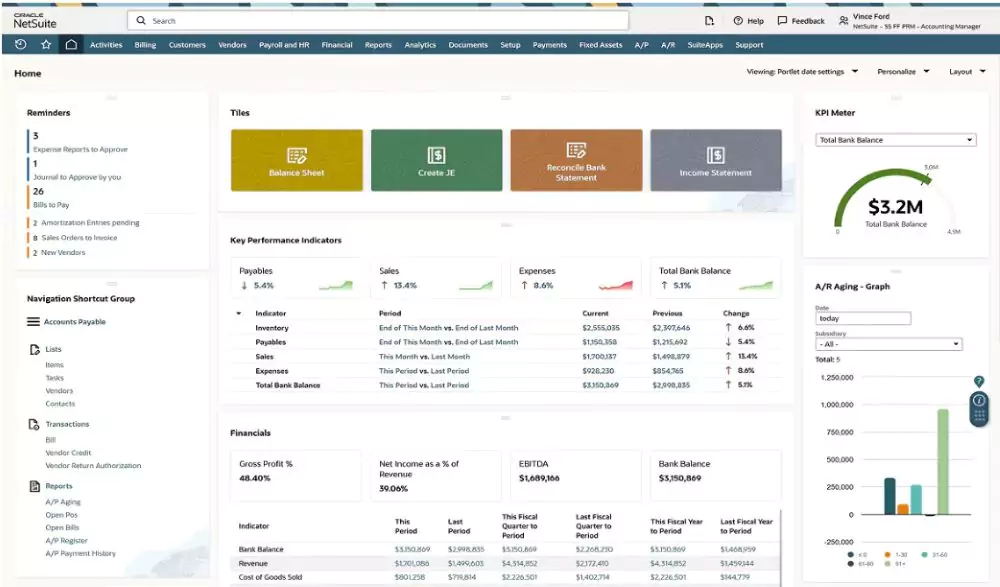

NetSuite

NetSuite is a leading cloud-based ERP platform that provides comprehensive financial management, automation, and scalability for organizations with complex operational and ownership structures. For family offices, NetSuite offers a flexible foundation to manage accounting, reporting, and financials across diverse investments and operating businesses.

A key differentiator for family offices is Rand Group’s custom NetSuite module for managing shared ownership allocation. This module was originally designed for joint ownership scenarios in other industries, but perfectly suited for family offices. This capability allows offices to accurately allocate expenses, revenues, and capital contributions across multiple entities, co-investments, or family members, providing transparency into ownership and financial performance across all holdings.

By leveraging NetSuite’s core ERP capabilities alongside shared ownership allocation, family offices can automate complex financial allocations, reduce manual reconciliation, and gain a clearer, real-time view of performance across entities and investments.

Key family office capabilities:

- Shared ownership allocation: Precisely allocate revenues, expenses, and capital contributions across multiple family members, entities, or co-investments. Ideal for family offices managing shared assets, partnerships, or operating companies with multiple stakeholders.

- Multi-entity accounting and consolidation: Manage financials across multiple legal entities and automatically consolidate results, eliminating reliance on spreadsheets and manual processes.

- Detailed ownership tracking: Track ownership percentages, cost-sharing arrangements, and financial responsibility at a granular level, supporting transparency, governance, and reporting accuracy.

- Automated billing and settlements: Streamline distributions, intercompany transfers, and settlements between entities or family members, reducing administrative effort and errors.

- Custom reporting and dashboards: Build tailored reports and dashboards to monitor financial performance by entity, investment, owner, or family group, enabling stakeholders to make informed decisions.

NetSuite is a strong choice for family offices that require flexibility, transparency in ownership structures, and advanced financial automation. When configured correctly, it can support complex multi-entity and investment structures while maintaining centralized financial control.

Best ERP software for family offices comparison

How to choose the best ERP for your family office

Selecting the right ERP for a family office is a critical decision that can impact financial oversight, operational efficiency, and long-term wealth management. Because family offices often manage complex portfolios, multiple entities, and multi-generational wealth, it’s important to evaluate ERP solutions carefully. Here are key considerations:

- Assess complexity: Begin by reviewing the structure and needs of your family office. Consider the number of legal entities, trusts, and investment vehicles you manage, as well as the level of reporting granularity required. Complex multi-entity holdings or diverse investment types may require a system with advanced consolidation, allocation, and reporting capabilities.

- Evaluate integration capabilities: Determine how well the ERP integrates with the tools and platforms your office already uses. This includes Excel, portfolio management systems, CRMs, and broader ecosystems such as Microsoft or Oracle. Seamless integration reduces manual work, ensures data accuracy, and allows for centralized financial oversight.

- Consider scalability and customization: Your family office will evolve over time, adding new investments, entities, or reporting requirements. Look for ERP solutions that can scale with your growth and support custom workflows, reporting, and dashboards. Flexibility is also essential for succession planning, as different generations may have distinct reporting or governance needs.

Want to learn more about ERP options for your family office?

Partner with Rand Group for a confident ERP selection. Our experts guide you through a structured process to identify your family office’s unique requirements, evaluate the best-fit solutions, and provide an objective, actionable recommendation, removing the guesswork from choosing the right system.

Select and implement the right ERP with Rand Group

Selecting the right ERP system is only the first step in transforming your family office’s financial operations. Equally important are implementation, customization, and ongoing support to ensure the solution delivers maximum value and continues to meet the evolving needs of the family office. We have extensive experience helping family offices navigate this process, combining deep technical expertise with an understanding of the unique challenges of multi-entity wealth management.

Our team offers comprehensive services tailored to family offices, including:

- ERP selection expertise: Evaluate top options like Sage Intacct, NetSuite, Dynamics 365 BC, and other platforms to match your unique needs.

- Custom implementation: Configure workflows, automate reporting, and integrate with existing systems for seamless operations.

- Ongoing support & optimization: Training, support, and updates ensure your ERP adapts as your family office grows.

- Proven experience: We’ve implemented ERP customizations for family offices, multi-entity businesses, and complex investment structures.

Next steps

Choosing the best ERP software for family offices is critical for managing multi-generational wealth efficiently. By focusing on multi-entity consolidation, investment tracking, and custom reporting, family offices can simplify operations and gain deeper financial insights. Our ERP experts are here to help guide the selection, implementation, and ongoing optimization of your chosen solution, ensuring your family office operates with efficiency, accuracy, and confidence. Reach out today to schedule a software selection engagement and start your family office transformation.