Essential guide to revenue recognition for nonprofits

Revenue recognition is critical for nonprofits to accurately report income and maintain compliance with accounting standards. Proper recognition helps stakeholders understand how funds are earned, used, and reported.

In this blog, we’ll cover how revenue recognition for nonprofits differs from for-profit accounting. We’ll also explain the fundamentals of ASC 606 and grant revenue recognition to clarify how these standards apply. In addition, we’ll outline best practices for handling exchange, nonreciprocal, and conditional contributions. Finally, we’ll explore how AI-powered accounting software enhances accuracy, improves compliance, and simplifies financial reporting for nonprofit organizations.

Let’s start with the accounting standards that guide nonprofit revenue recognition.

Nonprofit accounting standards and compliance

The Financial Accounting Standards Board (FASB) provides guidance for revenue recognition through ASC 606, which governs how organizations record revenue from contracts and exchange transactions. A core principle is that revenue must be recognized when it is earned, not merely when cash is received. Nonprofits must also distinguish between exchange and nonreciprocal transactions, such as unconditional contributions. This distinction ensures revenue is recorded accurately and consistently.

Adhering to FASB ASC 606 and the accounting standards codification (ASC) ensures transparency, accuracy, and compliance with generally accepted accounting principles (GAAP). Maintaining compliance is not only a regulatory requirement but also a cornerstone of public trust and donor confidence. It demonstrates responsible stewardship of funds. Furthermore, it shows a commitment to ethical financial reporting.

Get expert help selecting a nonprofit ERP solution

Get expert help with nonprofit ERP. From revenue recognition to multi-entity reporting, Rand Group ensures you choose the right system and streamline your operations.

Understanding nonprofit revenue recognition

Revenue recognition in nonprofits is a structured process that ensures income is recorded accurately and in compliance with accounting standards. These include ASC 606 and ASU 2018-08. The process outlines how and when organizations should recognize revenue from donations, grants, and program service fees. Following the process ensures a clear and transparent financial picture.

- Exchange transactions: Involve a reciprocal transfer of goods or services for revenue.

- Nonreciprocal transactions: Include unconditional contributions that do not involve an exchange.

- Conditional contributions: Have grantor or donor-imposed requirements that must be met before revenue can be recognized.

- Deferred revenue: Represents funds received before goods or services are delivered. It is recorded as a liability until earned.

Exchange transactions and the importance of equal value

The organization recognizes revenue from exchange transactions when it fulfills its performance obligations.

Example: A hospital pays your organization $200,000 to provide temporary housing for recovering patients. This is an exchange transaction, and revenue is recognized only after the services are delivered.

Importantly, for exchange transactions, the transaction price must reflect the fair value of goods or services provided. Nonprofits should verify that this price aligns with the actual economic value exchanged. Revenue is recognized when services rendered fulfill a performance obligation as defined in the contract. If the value of the goods or services changes, adjustments may be needed. Ensuring equal value helps prevent misstated revenue and reinforces compliance.

Non-reciprocal transactions

Nonreciprocal transactions occur when a nonprofit receives assets or funds without providing goods or services of commensurate value in return. These transactions are typically unconditional contributions, such as donations or grants made to support the organization’s mission without expectation of repayment or direct benefit to the donor.

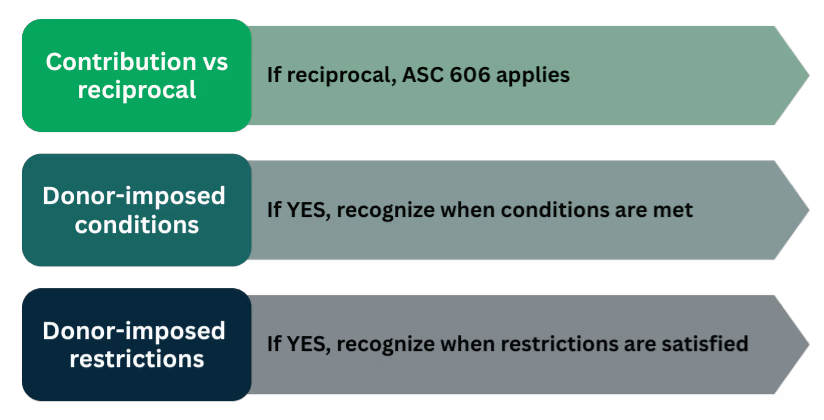

In revenue recognition for nonprofits, nonreciprocal transactions are recognized as revenue when the contribution is unconditional. This means the organization is entitled to the funds and no measurable barriers or performance obligations exist. The timing of recognition depends on whether the contribution includes donor-imposed restrictions or conditions:

- Unrestricted, unconditional contributions: Recognized as revenue immediately upon receipt or commitment.

- Restricted contributions: Recognized immediately but reported as restricted until the funds are used for the specified purpose.

- Conditional contributions: Not recognized until the stated condition (such as performance milestones) is met.

Example: A nonprofit is awarded $100,000 to be used exclusively for food assistance programs. This is an unconditional but restricted contribution. Revenue is recognized immediately but reported as restricted until the funds are used for the intended purpose.

Properly classifying and recognizing nonreciprocal transactions ensures compliance with FASB ASC 958. It also supports accurate, transparent nonprofit financial reporting. Clear documentation of donor intent and any restrictions helps maintain compliance and builds confidence among donors, regulators, and auditors. Organizations must track conditional and restricted contributions separately in accounting systems to prevent misstatements and ensure transparent reporting.

Conditional grants and contributions

Conditional grants and contributions include donor-imposed requirements, such as performance milestones or matching conditions. These must be met before revenue can be recognized. In contrast, donor-imposed restrictions dictate how funds may be used. They do not delay revenue recognition unless combined with specific conditions.

Revenue is recorded only when the required conditions are substantially met or explicitly waived by the donor. Nonprofits should carefully review each grant agreement to determine the appropriate timing for recognition. They should also identify any agreements with donor-imposed restrictions. These restrictions can affect both the timing and accuracy of financial reporting.

Example: A foundation provides a $100,000 grant, contingent upon a nonprofit successfully placing five families into permanent housing. If the condition is not met, the funds must be returned. This is a conditional grant. Revenue is recognized only when the condition has been satisfied.

Deferred revenue

Deferred revenue occurs when a nonprofit receives funds before delivering the promised goods or services. These funds are recorded as a liability until the organization has fulfilled its obligations. This ensures revenue is recognized in the correct period and aligns with generally accepted accounting principles (GAAP).

Common examples in nonprofits include:

- Membership fees collected in advance for future periods

- Program service fees received before programs are delivered

- Grants or sponsorships contingent on future program completion

Revenue is recognized from deferred sources once the performance obligation is met.

Example: A nonprofit receives $50,000 for a summer camp in January, but the camp runs in July. The funds are initially recorded as deferred revenue. The revenue is recognized in July as the program is delivered.

Revenue recognition best practices

Accurate revenue recognition depends on well-defined accounting procedures and regular review. Financial accountability relies on thorough documentation and accurate record-keeping. This supports compliance and audit readiness.

Establish a revenue recognition policy

Accurate revenue recognition requires clear documentation and consistent processes. However, many nonprofits still rely on spreadsheets to manage grants and contributions. This manual approach is not only labor-intensive but is also prone to data-entry errors and often not kept up to date.

As a result, financial data may not reflect real-time performance. This can hinder informed decision-making and create challenges during audits or compliance reviews.

To address these issues, every nonprofit should establish a formal revenue recognition policy. This policy should define:

- How revenue from various sources is recognized

- How to handle conditional and deferred revenue

- Procedures for reviewing complex transactions

- Roles and responsibilities for maintaining compliance

- Frequency of policy reviews and updates

A well-documented policy promotes consistency. It also reduces risk and supports clear communication with auditors, donors, and stakeholders. Ultimately, maintaining a structured revenue recognition policy helps ensure accuracy, transparency, and long-term compliance with accounting standards.

Transparent financial reporting

Transparent financial reporting is essential to nonprofit accountability. Financial statements should accurately reflect the organization’s financial position. This includes showing how and when revenue is recognized. Financial transparency helps maintain donor trust, while ensuring that stakeholders have access to clear, accurate information.

Nonprofits should provide detailed disclosures outlining revenue recognition policies. This gives donors and regulators confidence in reporting practices.

Proper management of revenue sources

Proper management of revenue sources ensures compliance with donor restrictions. It also supports informed budgeting decisions. Nonprofits should:

- Track restricted and unrestricted funds separately

- Regularly reconcile accounts

- Update revenue recognition policies as new funding models emerge

Effective financial management allows nonprofits to plan strategically and allocate resources efficiently.

Training and education

Proper training ensures staff and board members understand revenue recognition principles. It also ensures compliance with organizational policies. Nonprofits should invest in regular education sessions to stay informed about changing accounting standards and technologies. Ongoing education fosters consistency, reduces risk, and enhances financial literacy across the organization. Best practices:

- Establish a written revenue recognition policy

- Maintain transparent, detailed disclosures

- Separate restricted and unrestricted funds

- Review accounting procedures regularly

- Use automation and software tools to increase accuracy

Following these best practices ensures compliance, accuracy, and stakeholder confidence.

White Paper:

Nonprofit CFO survival guide

Explore essential strategies for nonprofit CFOs to streamline finance, tackle revenue recognition and compliance challenges, ensure accountability, and strengthen mission impact through cloud-based ERP solutions.

Automate revenue recognition with AI-powered cloud accounting software

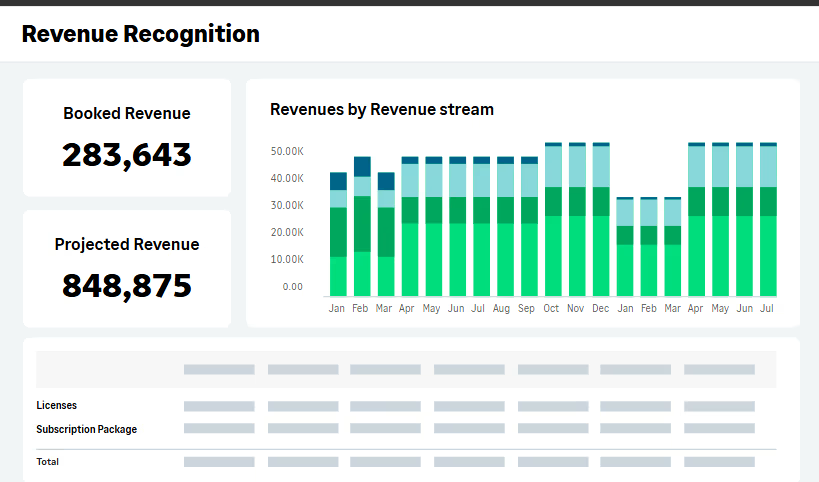

Modern accounting software and automation tools greatly simplify nonprofit revenue recognition. These tools reduce manual work, minimize errors, and ensure consistency across financial reports. Systems like Sage Intacct, NetSuite, and Microsoft Dynamics 365 provide features designed specifically for nonprofits. These include grant management, fund accounting, and compliance automation.

Automation enables nonprofits to:

- Accurately track conditional grants and deferred revenue

- Manage multi-year grants and reimbursable grants, including monitoring qualifying expenses

AI enhances these processes further:

- Automated categorization: Transactions can be automatically classified, ensuring revenue is recorded correctly

- Compliance made easy: Systems follow standards like ASC 606, reducing errors

- Pattern recognition: AI can detect trends in donations, grants, and contracts for accurate reporting

- Real-time insights: Predictive analytics can help forecast cash flow and guide financial decisions

- Collaboration anywhere: Cloud access allows finance teams, auditors, and board members to view up-to-date data anytime

How modern ERP systems simplify nonprofit revenue recognition

Selecting the right ERP solution is critical for managing the complex requirements of nonprofit revenue recognition. Leading cloud ERP systems like Microsoft Dynamics 365 Business Central, Dynamics 365 Finance & Operations, Sage Intacct, and NetSuite provide powerful automation and compliance tools. They streamline every step of the process—from grant management to financial reporting.

Each of these ERP systems empower nonprofits to:

- Automate compliance with ASC 606 and GAAP

- Manage restricted and unrestricted funds with precision

- Streamline deferred and conditional revenue recognition

- Gain real-time visibility into financial performance

- Reduce manual errors and improve audit readiness

By leveraging ERP systems purpose-built for financial transparency and compliance, nonprofits can confidently manage revenue recognition and focus on achieving their mission impact.

Microsoft Dynamics 365 Business Central

Business Central enables nonprofits to automatically recognize revenue based on performance obligations and donor restrictions. It also supports fund accounting, allowing organizations to manage restricted and unrestricted funds with accuracy and transparency. Built-in deferral templates make it easy to manage prepaid grants, membership dues, or program fees. Integration with Power BI and AI-driven insights helps finance teams visualize deferred revenue and forecast funding trends, improving transparency and accountability.

Microsoft Dynamics 365 Finance & Operations

For larger nonprofits or multi-entity organizations, Finance & Operations (F&O) offers advanced revenue recognition capabilities and global compliance support. The system provides configurable revenue schedules and flexible recognition rules that align with ASC 606 and ASC 958 requirements. F&O also integrates seamlessly with Grant and Project Management modules to ensure accurate tracking of conditional grants and multi-year funding.

Sage Intacct

Designed with nonprofits in mind, Sage Intacct delivers deep fund accounting, grant tracking, and donor restriction management. Its built-in Revenue Management module automates recognition across multiple funding sources, including grants, contributions, and program service fees. Intacct’s compliance with ASC 606 and ASU 2018-08 ensures consistent, auditable reporting. Real-time dashboards and dimensional reporting allow nonprofits to analyze funding by donor, program, or location—supporting strategic decisions and accountability.

NetSuite

NetSuite for nonprofits provides an integrated revenue recognition engine that supports both exchange and nonreciprocal transactions. It automates complex schedules, deferrals, and multi-element arrangements, ensuring revenue is recognized in alignment with contractual and donor conditions. NetSuite’s unified cloud platform connects fundraising, grant management, and financial reporting in one system, reducing manual effort and increasing audit readiness.

Conclusion

Accurate revenue recognition is vital for nonprofit transparency, compliance, and credibility. By adopting best practices and leveraging cloud-based ERP systems such as Sage Intacct, Microsoft Dynamics 365 Business Central, Dynamics 365 Finance & Operations, and NetSuite, organizations can automate compliance, simplify complex reporting requirements, and gain clear visibility into performance.

At Rand Group, we help nonprofits select, implement, and optimize accounting solutions that align with FASB and GAAP standards. Our experienced consultants ensure your ERP system supports accurate revenue recognition, streamlined financial processes, and the insights needed to drive sustainable impact.

Contact us to learn how we can help your nonprofit achieve accuracy, efficiency, and long-term financial success.