What you need to know about the 2022 year-end update for Dynamics GP

Microsoft released the Dynamics GP year-end update on November 15, 2022. This year-end update will be available for Microsoft Dynamics GP 2018 or later and will include the October 2022 release as well as all previous hot fixes and service packs. Below is a summary of the 2022 year-end changes included in this update:

- Fixed assets luxury auto depreciation changes

- Payables management 1099 form changes

- There are no payroll changes (W2, W3, EFW2)

It is important to note that mainstream support for Microsoft Dynamics GP 2016 ended in July 2021 and mainstream support for GP 2018 will end in January 2023. For this reason, if you are on Microsoft Dynamics GP 2016 or earlier and need to produce 1099s from GP, you will need to upgrade to a newer version in order to be able to apply the year-end update with the new 1099 forms. If you are on Microsoft Dynamics GP 2016 or earlier and do not upgrade, there will be no way to print accurate 1099 forms out of Microsoft Dynamics GP.

Fixed Assets luxury auto depreciation changes

The 2022 year-end update for Dynamics GP includes changes for the fixed assets module. In this release, the maximum depreciation deduction amounts allowed for luxury vehicles have been updated for assets placed in service in the calendar year 2022 to comply with IRS guidelines. There are no new functionalities included in this release that will affect fixed assets’ year-end closing processes. Full information on the luxury auto depreciation changes can be found on the IRS website: https://www.irs.gov/publications/p946

Payables Management 1099 Form changes

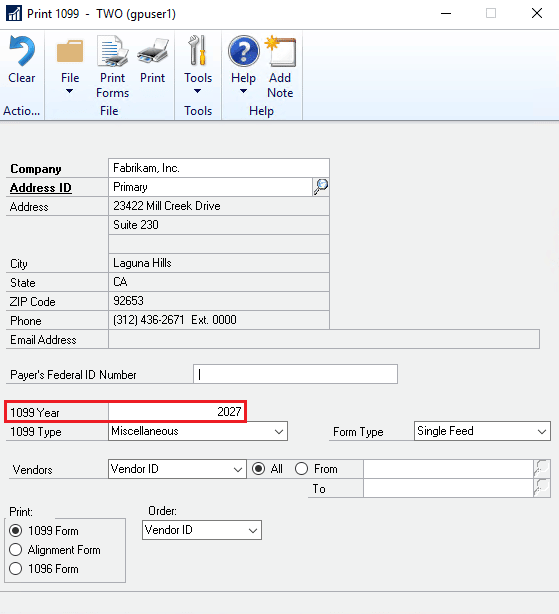

The IRS has made some form changes to 1099s for the 2022 tax year. If your company produces these forms out of Microsoft Dynamics GP, it will be necessary to either apply the 2022 year-end update or upgrade to a newer version of GP depending on which version you are utilizing. The IRS has removed the pre-printed year on all forms, so Dynamics GP will now print the year on the forms. This means that users will now need to enter the 1099 year in the Print 1099 window in Dynamics GP, as highlighted below. The system will then print the specified year on all printed forms.

In addition to the removal of the pre-printed year on all forms, the IRS made updates to the following individual forms:

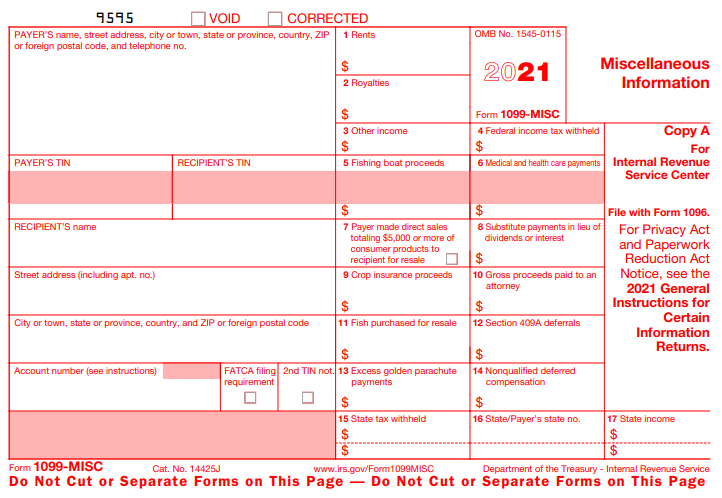

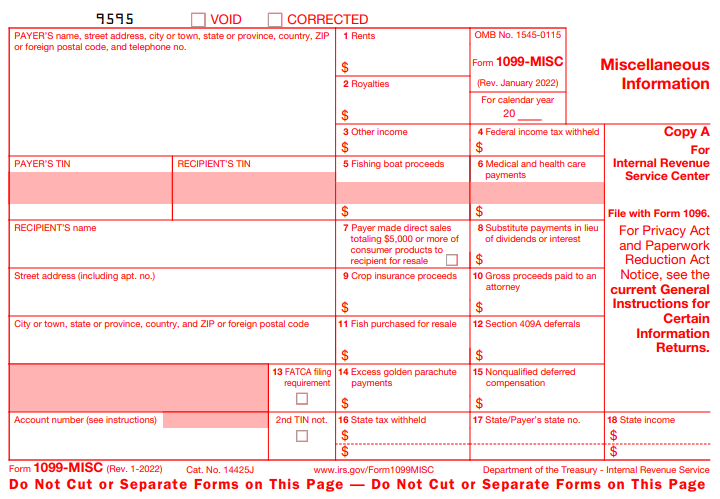

1099-MISC form changes

The IRS removed the pre-printed year from the form and separated that box into two boxes. The lower box is populated with a fillable field for the year, which is designated by the user in Dynamics GP. Additionally, the “Account Number” box and the “2nd TIN not.” box have both been moved down a line, leaving the “FATCA filing requirement” box by itself on the line above. Finally, the “FATCA Filing requirement” box has been relabeled as Box 13, resulting in all boxes to the right being renumbered as well.

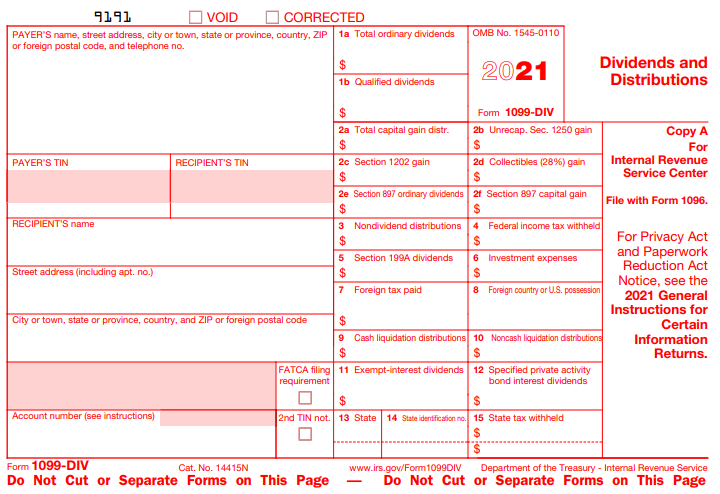

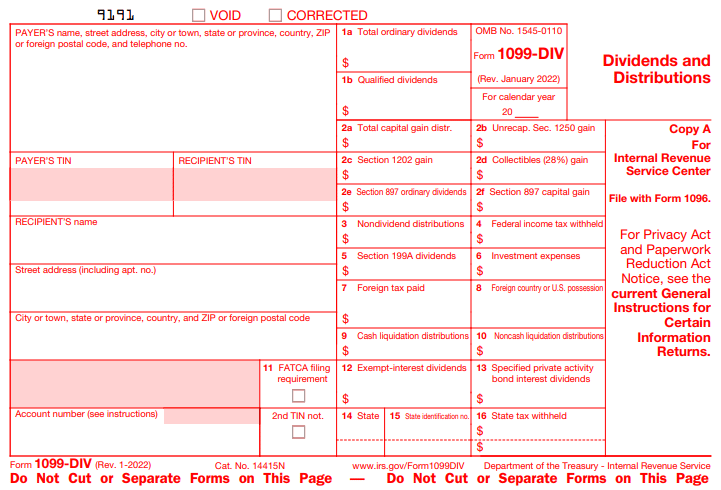

1099-DIV form changes

The removal of the pre-printed year from the form resulted in two new boxes in the top right of the form. The lower box is populated with a fillable field for the year, which is designated by the user in Dynamics GP. Additionally, the “FATCA Filing requirement” box has been labeled as Box 11, resulting in the boxes to the right being relabeled as well.

1099-NEC form changes

The only change from the IRS to the 1099-NEC form was the removal of the pre-printed year that separated the original box into two. The lower box is populated with a fillable field for the year, which is designated by the user in Dynamics GP. Additionally, with the October 2022 release of Dynamics GP, users can now print the 1099-NEC form with lines. This means users will no longer need to buy pre-printed 1099-NEC forms.

To print the 1099-NEC form with boxes and lines, follow the steps below:

- Navigate to Purchasing >> Routines >> Print 1099

- Enter the current year in the 1099 Year field

- Under Form Type, select One Wide with Box

- Add the remaining information in this window and select Print Forms File

Next steps

Rand Group recommends applying the year-end update well in advance of year-end to ensure you have sufficient time to successfully plan and execute the upgrade. If you have any questions regarding the year-end update or the new IRS changes, contact one of our Dynamics GP experts today. Additionally, if you are considering upgrading Dynamics GP, we can provide additional insights on the latest version of GP and help guide you through the considerations involved in upgrading your system.