What is Dynamics 365 Finance?

Business finance is no longer just about balancing the books or closing the month on time, it’s about driving strategy, improving efficiency, and helping the entire organization make smarter, faster decisions. But for many organizations, outdated ERP systems are holding them back. Older legacy tools can slow down reporting, create bottlenecks, and make it harder for teams to work together. Microsoft Dynamics 365 Finance offers a better way forward. Designed for modern finance teams, it brings intelligent automation, real-time insights, and global scalability, all delivered through a secure, cloud-based platform. This article provides an in-depth overview of Dynamics 365 Finance with key capabilities, benefits, and next step guidance for teams looking to boost their finance operations with D365 Finance’s robust functionality.

What is Microsoft Dynamics 365 Finance?

Microsoft Dynamics 365 Finance is a comprehensive cloud ERP solution designed to centralize and automate core financial operations. As part of the broader Microsoft Dynamics 365 ecosystem, it enables businesses to manage general ledger, budgeting, accounts payable and receivable, compliance, and financial reporting, while supporting multiple currencies, regions, and regulatory environments. These robust features are best suited for mid-size to large companies. Small to mid-sized businesses can find similar functionality with a better fit in D365 Business Central.

More than just an accounting tool, D365 Finance integrates with Microsoft tools like Power BI, Teams, Excel, and other Dynamics 365 applications that you use every day to provide a unified, data-driven platform that powers smarter financial management at scale.

Whether your organization operates in one country or across many, Dynamics 365 Finance offers the flexibility and control to streamline operations, ensure compliance, and drive better outcomes.

D365 Finance’s key features

Dynamics 365 Finance delivers a robust set of financial capabilities designed to support organizations of all sizes and industries.

Below is an overview of key features:

- General Ledger – Flexible chart of accounts, financial dimensions, and journal processing for comprehensive control.

- Budgeting & forecasting – Support for budget planning, scenario modeling, and forecasting to align financial strategy.

- Accounts Payable & Receivable – Streamlined invoice processing, vendor/customer management, and payment automation.

- Global regulatory compliance – Built-in tax engines, audit support, and localization for over 40 countries.

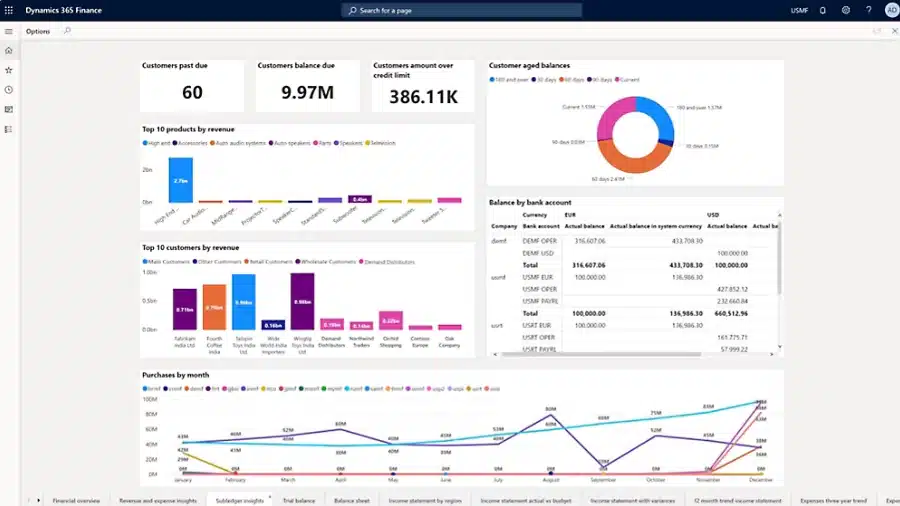

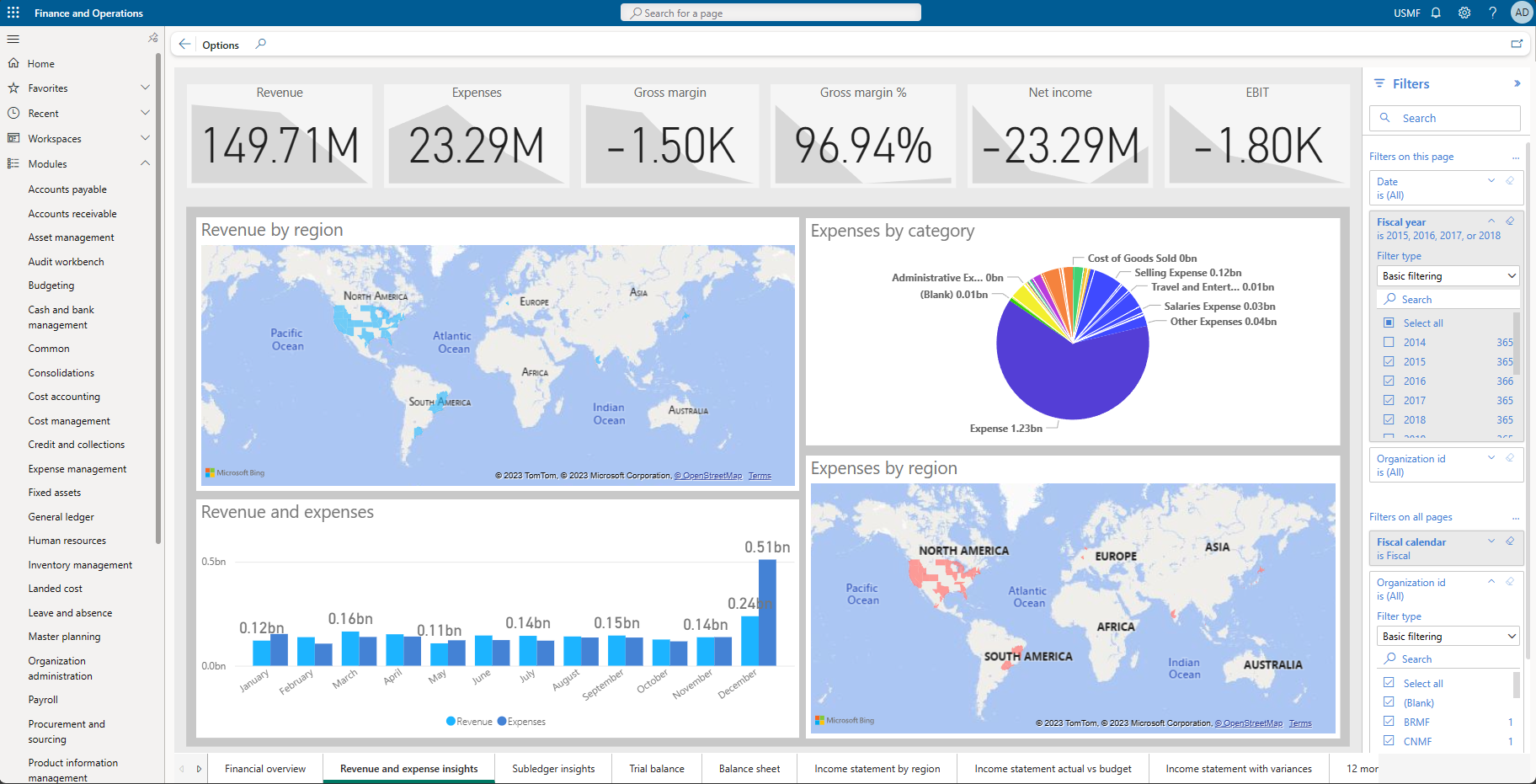

- Financial reporting & analytics – Real-time dashboards powered by Power BI and financial insights through configurable reports.

- Intercompany & multi-entity support – Manage multiple legal entities, currencies, and cross-entity transactions with ease.

- Fixed assets & lease accounting – Full asset lifecycle management and compliance with ASC 842/IFRS 16.

- Project accounting – Track budgets, costs, billing, and revenue for internal or client-based projects.

- Cash & bank management – Bank reconciliation, payment processing, and cash forecasting for liquidity visibility.

- AI & Microsoft Copilot Integration – Take advantage of built-in AI tools and Microsoft Copilot to enhance productivity and decision-making. Automate routine tasks like journal entry suggestions, detect financial anomalies, and get contextual insights, right within your workflow, helping your finance team act faster and more confidently.

Discover more of D365 Finance’s features and capabilties

Dynamics 365 Finance and Operations’ robust capabilities go behind the details highlighted in this article. To dive deeper into it’s powerful features that can transform your financial opertions visit our capabilities page.

Benefits of D365 Finance

By adopting Microsoft Dynamics 365 Finance, organizations gain significant operational and strategic advantages that drive efficiency, agility, and growth.

Streamlined financial processes

Dynamics 365 Finance automates many manual and repetitive tasks, such as journal entries, invoice processing, and reconciliations. Built-in workflow-driven approvals and batch processing reduce errors and accelerate the month-end close cycle. This automation not only saves time but also frees your finance team to focus on strategic initiatives rather than transactional work, improving overall productivity and accuracy.

Real-time decision-making

With seamless integration of Power BI and embedded analytics, Dynamics 365 Finance provides finance leaders with real-time visibility into financial performance across business units and geographies. Interactive dashboards and customizable reports enable finance teams to monitor key metrics, forecast trends, and identify risks proactively. This empowers organizations to make data-driven decisions quickly turning financial insights into competitive advantages.

Improved compliance and control

Global organizations face complex regulatory environments with ever-changing tax laws, accounting standards, and reporting requirements. D365 Finance helps maintain compliance by automating tax calculations, supporting multi-jurisdictional tax regulations, and adhering to recognized accounting standards like GAAP and IFRS. Additionally, it offers comprehensive audit trails and controls to ensure data integrity and transparency, reducing the risk of compliance violations and financial misstatements.

Scalability and flexibility

Dynamics 365 Finance is designed to scale with your business as it grows or changes. Whether you’re a mid-sized company expanding into new markets or a multinational enterprise managing dozens of subsidiaries, the solution adapts with minimal disruption. Its modular architecture allows you to add functionalities and users as needed, while the cloud-based platform supports multi-currency, multi-language, and multi-entity operations, all with reduced IT overhead and no need for complex infrastructure upgrades.

Reduced total cost of ownership

By leveraging Microsoft’s secure Azure cloud infrastructure, D365 Finance eliminates the need for costly on-premises hardware, maintenance, and upgrades. Cloud deployment reduces upfront capital expenditure and shifts expenses to a predictable subscription model. Additionally, the cloud environment offers built-in security, disaster recovery, and automatic updates, helping to lower operational risks and long-term IT costs.

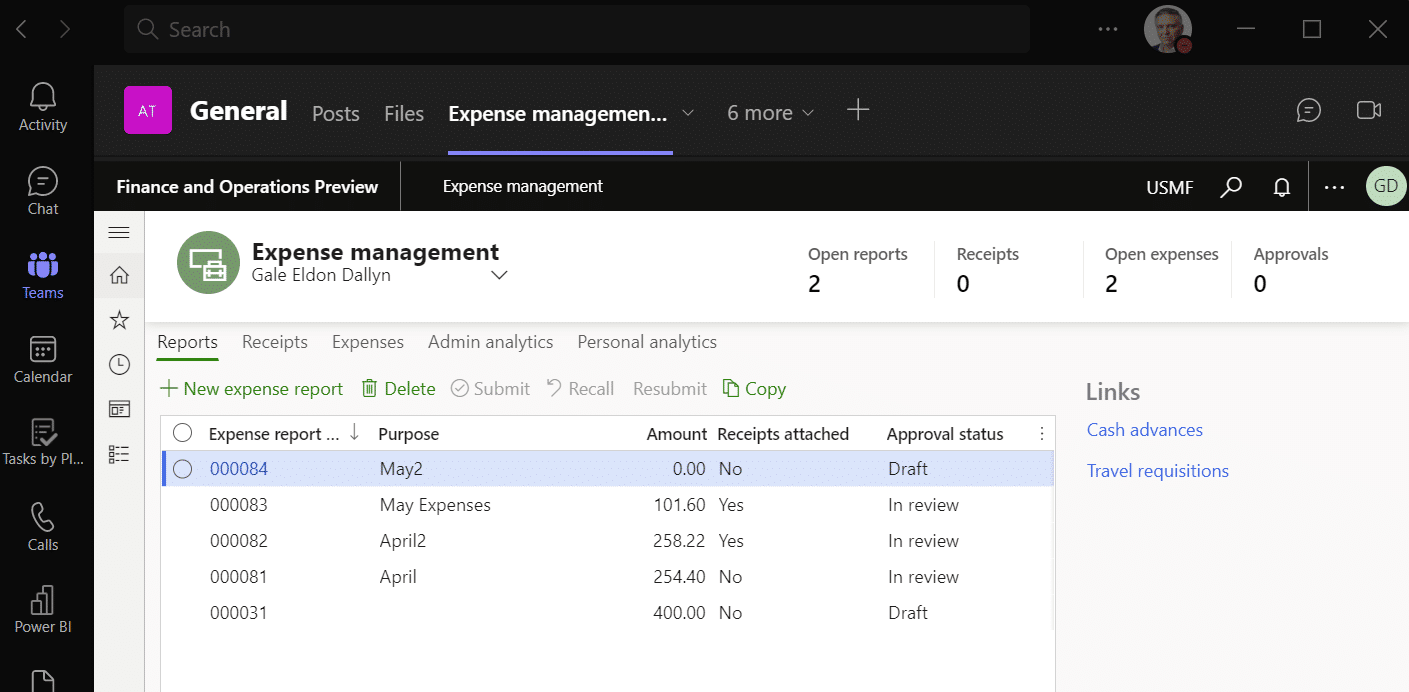

Enhanced collaboration

Integrated with Microsoft 365 tools like Excel, Outlook, and Teams, Dynamics 365 Finance promotes collaboration across finance, operations, and other departments. Finance teams can share real-time data, co-author reports, and communicate directly within familiar applications. This connected environment improves transparency, speeds up approvals, and fosters better alignment between finance and the broader business.

Capabilities of D365 Finance in the larger D365 Finance & Operations ecosystem

Microsoft Dynamics 365 Finance is a foundational component of the Dynamics 365 Finance & Operations (F&O) suite. When implemented alongside other Dynamics 365 applications, it creates a comprehensive, connected system that unifies financials with operations, supply chain, human resources, and project management. This connected ecosystem allows organizations to manage complex business processes in one place, eliminate silos, and make real-time, cross-functional decisions based on a single source of data.

Key integration capabilities include:

- Dynamics 365 Supply Chain Management – Synchronize procurement, inventory, production, and logistics with financial processes. For example, as goods are received, financial entries are automatically posted to the general ledger, and inventory valuation is updated in real time. This enables finance and operations teams to collaborate more effectively and manage cost of goods sold, margins, and inventory performance with greater precision.

- Dynamics 365 Project Operations – Link financials directly to project management activities, including budgeting, time and expense tracking, billing, and revenue recognition. This integration is especially valuable for professional services firms and project-based organizations, where the profitability of client work and internal initiatives relies on accurate financial visibility and control throughout the project lifecycle.

- Dynamics 365 Human Resources – Allocate and track employee costs, payroll accruals, and benefit expenses at a granular level. HR data can be leveraged for budget planning, headcount forecasting, and cost center reporting, helping finance teams understand the full impact of workforce expenses on profitability.

- Microsoft Power Platform – Extend D365 Finance with powerful, low-code tools. Use Power BI for custom dashboards and embedded analytics, Power Automate to streamline workflows like invoice approvals or journal entry alerts, and Power Apps to create tailored financial applications without custom development. These tools make it easy to tailor D365 Finance to unique business requirements while reducing development time and costs.

Dynamics 365 Finance pricing

Microsoft offers two version of Dynamics 365 Finance, Finance and Finance Premium. It’s important to work with an experienced Microsoft partner to evaluate your licensing requirements and design a cost-effective licensing plan that fits your organization’s size and growth strategy.

See a breakdown of their pricing structure below:

Get the complete D365 Finance & Operations licensing and pricing guide

Dynamics 365 Finance is a powerful financial management solution designed to streamline and modernize your core business processes. Its flexible, user-based or device-based licensing model allows organizations to scale as needed while aligning with their specific operational requirements. Download our guide to explore detailed pricing information, user types, licensing tiers, and key considerations to help you make the right investment.

Why Partner with Rand Group for your D365 Finance needs

Microsoft relies on certified partners like Rand Group to help businesses successfully evaluate, implement, and support Dynamics 365 Finance solutions. We are a trusted Microsoft Dynamics 365 partner with over 20 years of experience and a 90% client retention rate. Our team brings together financial, operational, and technical expertise to deliver ERP solutions that align with your strategic and regulatory requirements. From planning to go-live and beyond, we focus on delivering maximum value from your Dynamics 365 Finance investment. When you partner with us, you gain access to end-to-end services designed to ensure a successful implementation and long-term return on investment.

We provide:

- Financial software evaluation & selection – Our experts help you assess your financial and operational needs and recommend the right Dynamics 365 Finance modules and configurations. Whether you require global compliance features, multi-entity capabilities, or integrated forecasting, we guide you toward the right solution to fit your business goals.

- Seamless ERP implementation – We apply a proven, structured methodology to implement Dynamics 365 Finance with minimal disruption. Our consultants work closely with your team to plan and execute each phase, from system design and data migration to testing and user training, ensuring a smooth transition and faster time to value.

- Integration solutions – Our experts deliver full integration services to connect Dynamics 365 Finance with your other business systems, whether it’s your existing ERP, CRM, payroll, or industry-specific applications. We ensure that your data flows securely and efficiently across platforms to support complete financial visibility and operational efficiency.

- Customization & development – We tailor Dynamics 365 Finance to meet your unique business processes, regulatory requirements, and reporting needs. Our technical team can build advanced workflows, financial reports, custom data entities, or localized features, ensuring the solution works exactly the way your organization needs it to.

- Ongoing support & optimization – Post-launch, we offers comprehensive training, responsive support, and proactive system maintenance to keep your ERP solution secure, up-to-date, and performing optimally. As your business evolves, we continue to support you with process improvements, system enhancements, and strategic guidance.

Partnering with Rand Group means more than just implementing an ERP system, you gain a trusted advisor dedicated to your digital transformation success. From evaluation to execution and beyond, we’re here to help you get the most out of your D365 Finance investment.

Next steps: Learn how D365 Finance can transform your organization

Now is the time to modernize your financial systems and position your business for future growth. With D365 Finance, you can streamline operations, ensure compliance, and make faster, more strategic decisions. Partner with our Microsoft experts to ensure a successful implementation and long-term support for your digital transformation journey. Contact our team today to schedule a discovery session. We’ll evaluate your current financial processes, explore how D365 Finance can address your needs, and provide a roadmap tailored to your unique business needs.