What are AI Agents in Microsoft Dynamics 365 Finance & Operations?

AI agents in Dynamics 365 Finance & Operations are intelligent capabilities that analyze ERP data, apply business context, and execute tasks or recommendations with limited human input. They are designed to support finance and operations teams as transaction volumes grow and processes become more complex.

In this blog, we explain what AI agents are, how they work inside Dynamics 365 Finance & Operations, where they deliver value today, and how organizations can get started.

What is Dynamics 365 Finance & Operations?

Microsoft Dynamics 365 Finance & Operations is an enterprise resource planning (ERP) platform designed for large and global organizations with complex financial and operational needs. It supports core business functions, including general ledger, budgeting, accounts payable and receivable, procurement, inventory, manufacturing, and global trade. Because it is built for scale, the platform enables organizations to manage high transaction volumes, complex multi-entity structures, and diverse regulatory requirements across multiple regions. As a result, finance and operations teams can work from a single system of record instead of disconnected tools and spreadsheets.

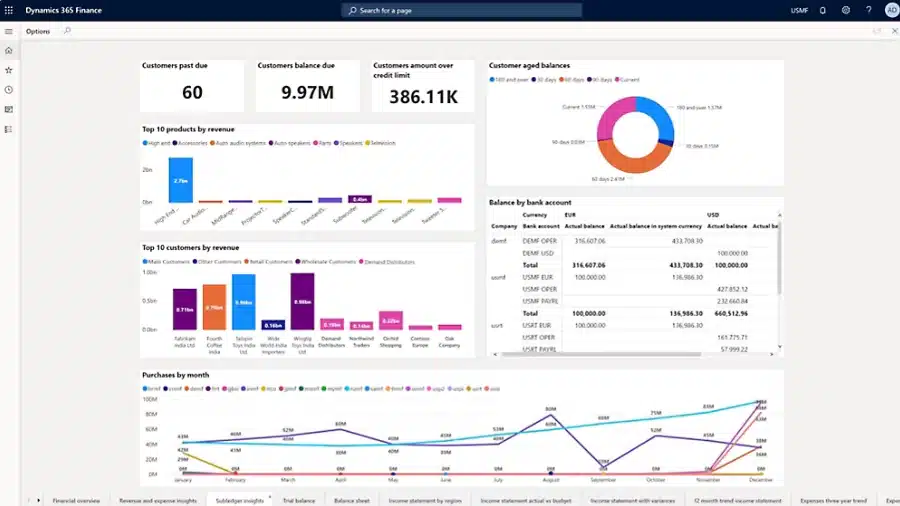

Dynamics 365 Finance & Operations consists of two primary applications: Dynamics 365 Finance and Dynamics 365 Supply Chain Management. Dynamics 365 Finance focuses on financial management, compliance, reporting, and global operations, while Dynamics 365 Supply Chain Management supports planning, sourcing, manufacturing, warehousing, and logistics. Together, they provide end-to-end visibility from financial performance to physical operations. Embedded intelligence and automation are built into the platform, enabling data-driven insights, proactive alerts, and increasingly autonomous processes across finance and supply chain workflows.

What are AI agents in Dynamics 365 Finance & Operations?

AI agents in Dynamics 365 Finance & Operations are intelligent, task-oriented capabilities that can analyze data, make decisions within defined boundaries, and take action with limited human intervention. Unlike traditional rules-based automation, these agents are designed to adapt based on context, patterns, and outcomes. They operate directly within Dynamics 365 Finance and Dynamics 365 Supply Chain Management, using ERP data to support real operational and financial processes. In practice, AI agents help teams move from reactive work to more proactive and consistent execution.

Within Dynamics 365 Finance & Operations, AI agents work alongside users, Copilot experiences, and the Power Platform to support both finance and supply chain scenarios. They can monitor transactions, flag exceptions, recommend next steps, and in some cases initiate workflows automatically. This allows organizations to manage complexity at scale without increasing manual effort. As Microsoft continues to embed AI more deeply into the platform, AI agents play a growing role in improving efficiency, accuracy, and decision quality across enterprise operations.

Benefits of AI agents in Dynamics 365 Finance & Operations

- Reduced manual effort by automating routine, high-volume finance and supply chain tasks

- Faster issue detection through continuous monitoring of transactions and operational data

- More consistent decision-making based on data patterns rather than individual judgment

- Improved accuracy by reducing human error in repetitive processes

- Better visibility into risks, exceptions, and performance trends

- Scalable support for global operations without adding headcount

Evaluate AI agents for Dynamics 365 Finance & Operations

Rand Group helps organizations identify where AI agents add value and align them with existing Dynamics 365 Finance & Operations processes. The result is practical automation that supports finance and operations teams without adding risk.

How AI agents work in Dynamics 365 Finance & Operations

AI agents in Dynamics 365 Finance & Operations work by combining ERP data, business rules, and machine learning models to observe what is happening in the system and respond appropriately. They rely on structured data from Dynamics 365 Finance and Operations, such as transactions, master data, forecasts, and operational events. This data provides the business context needed to understand normal patterns, identify exceptions, and evaluate potential actions. Because the agents operate inside the ERP, they use real-time and near-real-time information rather than static exports or reports.

From there, AI agents follow a cycle of signals, decisions, and actions. Signals may include threshold breaches, unusual patterns, delays, or changes in demand or cost. Decision logic determines how the agent responds, based on trained models, historical outcomes, and defined business policies. Actions can range from generating recommendations for users to triggering workflows or alerts. Importantly, human oversight remains part of the process, allowing organizations to control where agents advise versus where they act automatically.

Core components behind AI agents in Dynamics 365 Finance & Operations

- Data sources: Financial transactions, supply chain events, forecasts, and historical performance data within the ERP

- Signals and triggers: Events such as variances, exceptions, delays, or trend changes that prompt agent evaluation

- Decision logic: Business rules combined with AI models that assess context and determine next steps

- AI models: Machine learning models that detect patterns, predict outcomes, and improve decisions over time

- Actions: Recommendations, alerts, workflow initiation, or automated responses within defined limits

- Business context: Organizational policies, approval structures, and operational constraints that guide agent behavior

Current AI agents available in Dynamics 365 Finance & Operations

Microsoft has begun releasing purpose-built AI agents and embedded intelligence capabilities within Dynamics 365 Finance & Operations to support common finance and operational scenarios. These agents are designed to work directly with ERP data, helping teams reduce manual work and respond faster to issues. As part of Microsoft’s broader AI strategy, new agents are being introduced through regular platform updates and deeper Copilot integration. Over time, this approach expands how AI agents in Dynamics 365 Finance & Operations support day-to-day execution rather than isolated analytics.

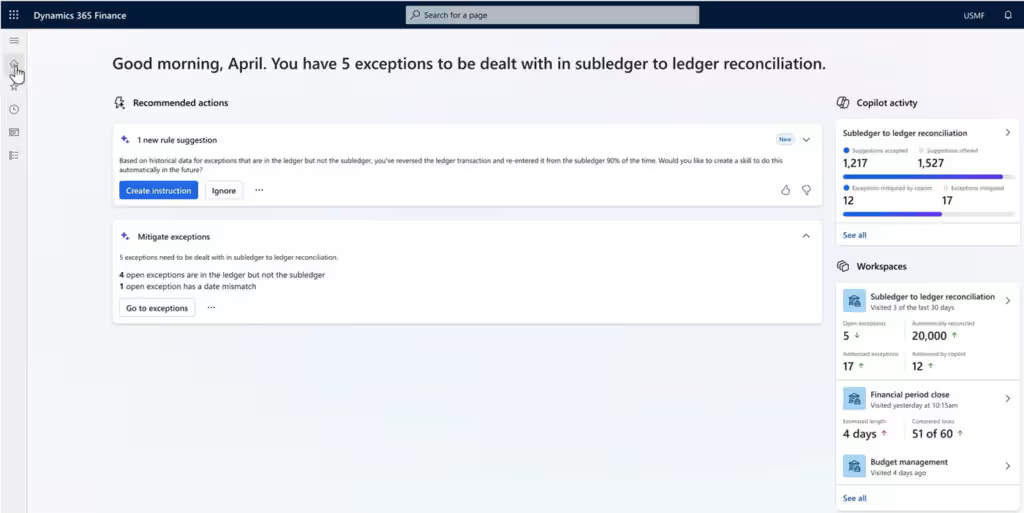

Account reconciliation agent

The account reconciliation agent focuses on automating and streamlining the reconciliation process for high-volume accounts. It analyzes transactions, identifies matching entries, and flags discrepancies that require review. By working directly within Dynamics 365 Finance & Operations, the agent helps finance teams close periods faster while maintaining control and auditability. This reduces reliance on manual matching and spreadsheet-based reconciliations.

- Matches transactions across accounts using predefined logic and learned patterns

- Flags exceptions and unmatched items for review

- Reduces time spent on repetitive reconciliation tasks

- Supports more consistent and auditable close processes

Supplier communications agent

The supplier communications agent helps manage routine interactions with suppliers by using ERP data to provide timely and accurate responses. It can reference purchase orders, invoices, and delivery status to address common supplier questions. By handling standard communications, the agent reduces interruptions for procurement and operations teams. This improves response consistency while keeping humans involved when judgment or escalation is required.

- Responds to common supplier inquiries using ERP data

- Improves visibility into order and invoice status

- Reduces manual email handling for procurement teams

- Supports more consistent supplier communication

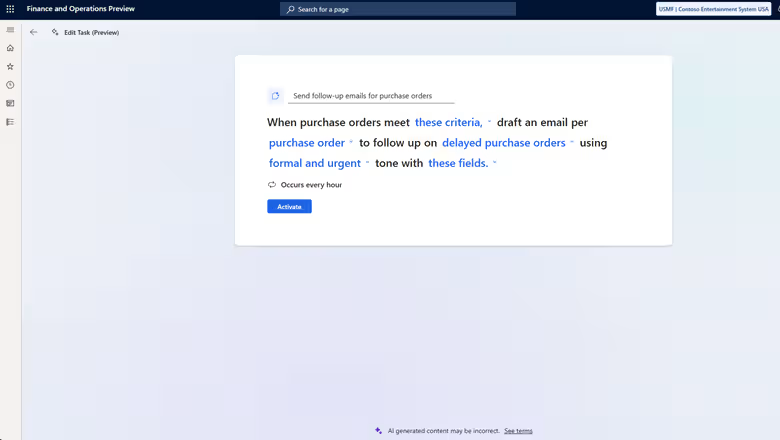

Custom AI agents

Beyond these Microsoft-provided capabilities, organizations are not limited to out-of-the-box agents. Dynamics 365 Finance & Operations can serve as a data foundation for custom AI agents built using Microsoft Copilot Studio and the Power Platform. These agents can be tailored to specific business processes, policies, and risk tolerances, while still operating within ERP workflows.

- Build custom agents using Dynamics 365 Finance & Operations data

- Align agent behavior with internal business rules and approvals

- Extend AI support to industry-specific or organization-specific scenarios

Common use cases for AI agents in Dynamics 365 Finance & Operations

AI agents in Dynamics 365 Finance & Operations are most effective in areas where teams manage large data volumes, frequent exceptions, and time-sensitive decisions. These agents continuously review financial and operational activity, identify patterns, and surface issues that require attention. As a result, organizations can shift effort away from manual monitoring and toward higher-value analysis and decision-making. Over time, this leads to more predictable operations and better use of ERP data across finance and operations teams.

Common use cases for AI agents in Dynamics 365 Finance & Operations

- Financial close and variance analysis: Monitor account activity, identify unusual variances, and highlight reconciliation issues before period close

- Cash flow forecasting and risk identification: Analyze payment trends, open receivables, and commitments to flag potential liquidity risks

- Supply chain planning and demand signals: Detect demand changes, inventory imbalances, and supply disruptions using operational data

- Exception handling and issue prioritization: Surface high-impact issues first, based on risk, cost, or service impact

- Executive insights and operational monitoring: Provide summarized insights and alerts that support faster, data-driven leadership decisions

AI agents vs Copilot in Dynamics 365 Finance & Operations

AI agents and Copilot both play important roles in how AI is applied within Dynamics 365 Finance & Operations, but they serve different purposes. Copilot is designed to assist users through natural language interaction, helping them understand data, complete tasks faster, and navigate the system more efficiently. In contrast, AI agents in Dynamics 365 Finance & Operations focus on executing work. They monitor data, respond to events, and take action within defined boundaries, often without direct user involvement. Together, they support both productivity and operational efficiency, but they are used in different ways.

Price and cost of AI agents in Dynamics 365 Finance & Operations

AI agents in Dynamics 365 Finance & Operations use a consumption-based pricing model rather than a fixed license. Microsoft measures AI usage through Copilot Credits, which account for AI interactions such as retrieving information, generating responses, and executing agent actions. Copilot Credits are priced at $0.01 per credit, and the number of credits consumed depends on task complexity, agent design, and how frequently the agent runs. As a result, costs scale with actual usage rather than the number of agents deployed.

Some AI agent capabilities in Dynamics 365 Finance & Operations are included with existing licensing, while others require additional Copilot Credit consumption. Organizations can also build custom AI agents using Microsoft Copilot Studio, which is priced on a pay-as-you-go basis using Copilot Credits or through a prepaid credit commitment. Because Microsoft does not publish per-agent pricing, cost control depends on thoughtful agent design, clear triggers, and defined usage boundaries. Contact Rand Group today for a practical estimate based on your Dynamics 365 Finance & Operations environment.

Key pricing considerations for AI agents in Dynamics 365 Finance & Operations

- AI agents use Copilot Credits for AI interactions and actions

- Pricing is pay-per-use, based on task complexity and frequency

- There is no flat per-agent fee published by Microsoft

- Custom agents require Copilot Studio and consume additional credits

- Governance and design decisions directly impact long-term cost

How to get started with AI agents in D365 Finance & Operations

Getting started with AI agents in Dynamics 365 Finance & Operations requires more than turning on a feature. Organizations need to understand where automation will create measurable impact and how AI agents should operate within existing controls. This is where partnering with Rand Group adds value. Rand Group works with finance and operations leaders to evaluate workflows, transaction volumes, and recurring pain points. From there, the focus shifts to identifying where AI agents in Dynamics 365 Finance & Operations can reduce manual effort, improve accuracy, and support better decisions without introducing unnecessary risk.

Rand Group takes a structured, practical approach to designing and deploying AI agents. This includes configuring Microsoft-provided capabilities as well as building custom agents that align with industry needs and internal policies. Because AI agents evolve over time, Rand Group also supports governance, optimization, and long-term performance management. The result is not just an initial deployment, but a sustainable approach to using AI inside the ERP as business needs change.

- Identifying high-impact opportunities: Analyze processes, transaction volumes, and exception rates to target areas where AI agents deliver the most value

- Designing and configuring AI agents: Configure out-of-the-box agents and design custom agents using the Power Platform that work directly with ERP data

- Extending the platform: Build custom or industry-specific agents that support unique workflows and compliance requirements

- Ongoing optimization and governance: Monitor performance, refine decision logic, and ensure agents operate within defined controls over time

- Long-term support partnership: Provide continuous guidance and support as Microsoft expands AI capabilities in Dynamics 365 Finance & Operations

For teams that want structured, hands-on learning before implementation, Rand Group also offers AI workshops focused on Microsoft Copilot, AI agents, and real Dynamics 365 F&O use cases.

Frequently asked questions (FAQs)

- What are AI agents in D365 Finance & Operations?

AI agents in Dynamics 365 Finance & Operations are intelligent, task-driven capabilities that monitor ERP data, evaluate business context, and take action within defined controls. They are designed to automate high-volume finance and operations work, surface risks and exceptions, and support consistent execution with minimal manual intervention. - How are AI agents priced in Dynamics 365 Finance & Operations?

AI agents in Dynamics 365 Finance & Operations use a consumption-based pricing model based on Copilot Credits. Each AI interaction or action consumes credits depending on task complexity and frequency, with Copilot Credits priced at $0.01 per credit. Costs scale with actual usage rather than a fixed per-agent fee. - What is the difference between AI agents and copilot?

Copilot assists users through natural language interaction and recommendations, while AI agents focus on executing tasks. AI agents in Dynamics 365 Finance & Operations monitor data, respond to events, and automate workflows, often without a user prompt. - How are AI agents different from Power Automate flows?

Power Automate flows follow predefined rules and steps, executing the same logic every time. AI agents add decision-making by evaluating context, patterns, and outcomes, allowing them to adapt their actions based on ERP data rather than fixed conditions alone. - Are AI agents available in D365 F&O?

Yes, Microsoft provides select AI agents within Dynamics 365 Finance & Operations. These agents focus on common scenarios such as reconciliation and supplier communication, with additional capabilities released through ongoing platform updates. - Are AI agents included in the Dynamics 365 Finance & Operations license?

Some AI agent capabilities are included with existing Dynamics 365 Finance & Operations licensing, while others require additional Copilot Credit consumption. Custom AI agents built using Microsoft Copilot Studio are not included by default and incur usage-based costs. Availability and cost depend on the specific agent and how it is used. - Can AI agents be customized for specific industries or processes?

Yes, AI agents can be customized using Dynamics 365 Finance & Operations data along with the Power Platform and Copilot Studio. This allows organizations to design agents that support industry-specific workflows, internal policies, and unique operational requirements. - How do organizations prepare to use AI agents in D365 F&O?

Organizations often start by building a practical understanding of Microsoft Copilot, AI agents, and governance considerations. Rand Group offers AI workshops that provide hands-on experience with AI inside Dynamics 365 and Microsoft 365 using real business scenarios.

Next steps

AI agents in Dynamics 365 Finance & Operations are already changing how organizations manage finance and operations at scale. To apply them effectively, teams need the right design, controls, and long-term support. Rand Group helps organizations deploy and extend AI agents in Dynamics 365 Finance & Operations in a practical, sustainable way. Contact us today to start the conversation.